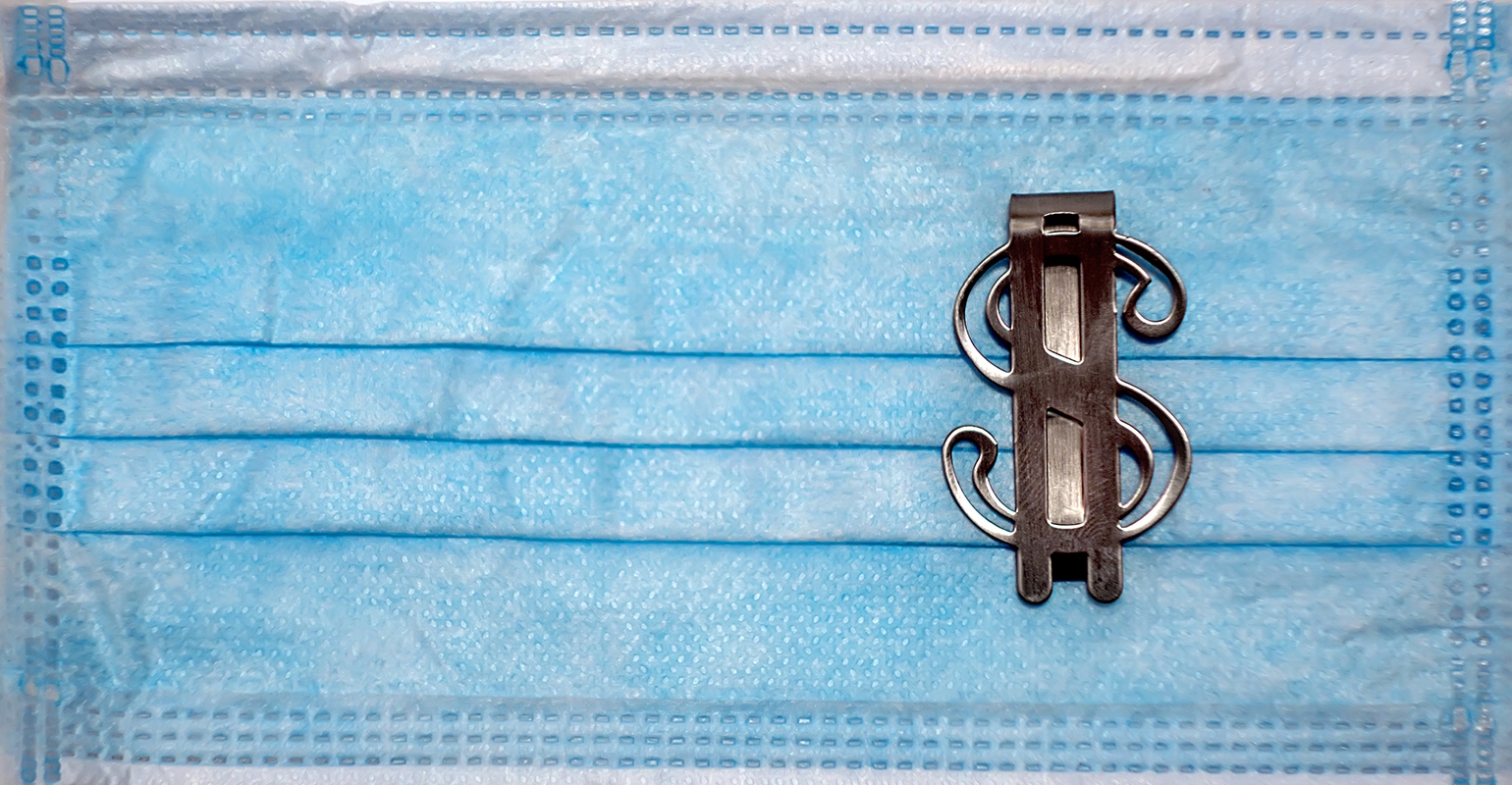

While most advisors successfully adapted to remote work and saw their AUM rise during the pandemic, nearly 3,000 took PPP loans.

August 30, 2021

For financial advisors, and the ecosystem of support platforms that surround them, the pandemic has been a challenging time but also a profitable one.

The challenging part—the “adapting-to-remote-work” story line—has been beaten to death. At this point, we get it: Advisors have successfully transitioned to a remote work environment.

Another story line—the one about how the pandemic has been a boon to advisors—is less common. Firms that charge clients a percentage of assets under management (which means most advisory firms) have seen their revenue increase dramatically since March 15, 2020, the day government officials called an end to large-scale gatherings (and for our purposes the beginning of the COVID-19 pandemic.)

From the close of the market on that day, to Aug. 24, 2021, the Standard and Poor’s 500 Index has returned 88%. Vanguard’s Balanced Index Fund, which most closely resembles a 60% equity, 40% bond portfolio, is up over 50% on a price basis.

Granted this is an imprecise proxy, but a back-of-the-envelope calculation suggests an investment advisor adhering strictly to a 60/40 portfolio and managing $250 million at the beginning of the pandemic—earning $2.5 million in revenue, based on an average 1% AUM fee—theoretically is now managing $375 million and earning $3.7 million, without effort. Who else has earned that pay raise? Where is the crisis?

FINRA Examining Certain Reps Who Took PPP Loans

This isn’t a criticism; most financial advisors do more for their clients than tend to their investment portfolios. And in March 2020, the market took a significant dip, and no one knew exactly where it was going to go.

Still, advisors preach to clients to take the long view. Now we have some idea of how many firms didn’t take their own advice. According to a study, Fraud and Abuse in the Paycheck Protection Program? Evidence from Investment Advisory Firms by William Beggs of the University of San Diego and Thuong Harvison of the University of Arizona, 2,999 investment advisory firms—or roughly one in four registered firms—took Paycheck Protection Program loans, a federally subsidized program meant to help small businesses hurt by the pandemic.

Those businesses took $590 million from the program, according to the researchers, or almost $200,000 each, on average. To get the loans forgiven, recipients needed only to show they did not reduce head count during the pandemic—few did, so free money to them. To make matters worse, these researchers estimate some 6% of the total amount was fraudulent—an overinflated request from the program beyond what was required to sustain the firms. Call me a cynic, but that number seems low.

No one will criticize firms for doing what they needed to do early in the pandemic to ensure their continuity. But for those that benefited from the program: Consider sharing some of the largesse with your clients. If they had not kept their assets—and their confidence—with you when things looked bleak, you might have actually needed the government-backed welfare you received.

David Armstrong

Editor-In-Chief

David Armstrong

Executive Director, Content and User Engagement at WealthManagement.com, Informa

Feb 11, 2025

Feb 11, 2025

Feb 11, 2025

Featured WMIQ Research

Why convergence is coming and what it means.

Estate Planning in a New Political Era: The 2025 Playbook

Turning Taxes into Opportunities: How Direct Indexing Can Help Drive Value

WealthManagement.com Industry Awards 2025: Top Tips for Submitting a Winning Nomination

2025 Compliance Outlook: Essential Strategies for Financial Advisors

Latest Digital Edition

Feature on Ultra-High-Net-Worth Families & Family Offices

Copyright © 2025 Informa Connect Limited. Registered in England & Wales with number 01835199, registered office 5 Howick Place, London, SW1P 1WG.