Aniah’s Law: Bond denied for mother accused in Lanett shaken baby murder WKRG News 5

source

Trade lanes were already shifting from historical patterns before trade war began, Boston Consulting Group says.

Geopolitical rivalries, alliances, and aspirations are rewiring the global economy—and the imposition of new tariffs on foreign imports by the U.S. will accelerate that process, according to an analysis by Boston Consulting Group (BCG).

Without a broad increase in tariffs, world trade in goods will keep growing at an average of 2.9% annually for the next eight years, the firm forecasts in its report, “Great Powers, Geopolitics, and the Future of Trade.” But the routes goods travel will change markedly as North America reduces its dependence on China and China builds up its links with the Global South, which is cementing its power in the global trade map.

“Global trade is set to top $29 trillion by 2033, but the routes these goods will travel is changing at a remarkable pace,” Aparna Bharadwaj, managing director and partner at BCG, said in a release. “Trade lanes were already shifting from historical patterns and looming US tariffs will accelerate this. Navigating these new dynamics will be critical for any global business.”

To understand those changes, BCG modeled the direct impact of the 60/25/20 scenario (60% tariff on Chinese goods, a 25% on goods from Canada and Mexico, and a 20% on imports from all other countries). The results show that the tariffs would add $640 billion to the cost of importing goods from the top ten U.S. import nations, based on 2023 levels, unless alternative sources or suppliers are found.

In terms of product categories imported by the U.S., the greatest impact would be on imported auto parts and automotive vehicles, which would primarily affect trade with Mexico, the EU, and Japan. Consumer electronics, electrical machinery, and fashion goods would be most affected by higher tariffs on Chinese goods. Specifically, the report forecasts that a 60% tariff rate would add $61 billion to cost of importing consumer electronics products from China into the U.S.

As 2025 continues to bring its share of market turmoil and business challenges, the Retail Industry Leaders Association (RILA) has stayed clear on its four-point policy agenda for the coming year.

That strategy is described by RILA President Brian Dodge in a document titled “2025 Retail Public Policy Agenda,” which begins by describing leading retailers as “dynamic and multifaceted businesses that begin on Main Street and stretch across the world to bring high value and affordable consumer goods to American families.”

RILA says its policy priorities support that membership in four ways:

“As Congress and the Trump administration move forward to adopt policies that reduce regulatory burdens, create economic growth, and bring value to American families, understanding how such policies will impact retailers and the communities we serve is imperative,” Dodge said. “RILA and its member companies look forward to collaborating with policymakers to provide industry-specific insights and data to help shape any policies under consideration.”

As the Trump Administration threatens new steps in a growing trade war, U.S. manufacturers and retailers are calling for a ceasefire, saying the crossfire caused by the new tax hikes on American businesses will raise prices for consumers and possibly trigger rising inflation.

Tariffs are taxes charged by a country on its own businesses that import goods from other nations. Until they can invest in long-term alternatives like building new factories or finding new trading partners, companies must either take those additional tax duties out of their profit margins or pass them on to consumers as higher prices.

The Trump Administration on Thursday announced it may impose “reciprocal tariffs” on any country that currently holds tariffs on the import of U.S. goods. That step followed earlier threats to apply tariffs on the import of steel and aluminum beginning March 12, another plan to charge tariffs on the import of materials from Canada and Mexico—now postponed until early March—and new round of tariffs on imports from China including a 10% blanket increase and the elimination of the “de minimis” exception for individual items under a value of $800 each.

American business groups had loudly pushed back against those earlier rounds of potential tariffs. And now they are raising their voices again to oppose the latest concept of “reciprocal tariffs.”

Various industry groups say that while the Administration may have legitimate goals in ramping up a trade war—such as lowering foreign tariff and non-tariff trade barriers—applying a strategy of hiking tariffs on imports coming into America would inflict economic harm on U.S. businesses and consumers.

“This tariff-heavy approach continues to gamble with our economic prosperity and is based on incomplete thinking about the vital role ethical and fairly traded imports play in the prosperity,” Steve Lamar, president and CEO of The American Apparel & Footwear Association (AAFA) said in a release. “Putting America first means ensuring predictability for American businesses that create U.S. jobs; affordable options for American consumers who power our economy; opportunities for farmers who feed our families; and support for tens of millions of U.S. workers whose trade dependent jobs make our factories, our stores, our warehouses, and our offices function. Sweeping new tariffs — a possible outcome of this exercise — instead puts America last, raising costs for American manufacturers for critical inputs and materials, closing key markets for American farmers, and raising prices for hardworking American families.”

A similar message came from the National Retail Federation (NRF), whose executive vice president of government relations, David French, said: “While we support the president’s efforts to reduce trade barriers and imbalances, this scale of undertaking is massive and will be extremely disruptive to our supply chains. It will likely result in higher prices for hardworking American families and will erode household spending power. We encourage the president to seek coordination and collaboration with our trading partners and bring stability to our supply chains and family budgets.”

The logistics tech firm Körber Supply Chain Software has a common position. "The imposition of new tariffs, or the suspension of tariffs, introduces substantial challenges for businesses dependent on international supply chains. Industries such as automotive and electronics, which rely heavily on cross-border trade with Mexico and Canada, are particularly vulnerable,” Steve Blough, Chief Strategist at Körber Supply Chain Software, said in an emailed statement. “Supply chains that are doing low-value ecommerce deliveries will have their business model thrown into complete disarray. The increased costs due to tariffs, or the increased costs in processing time due to suspensions, may lead to higher consumer prices and processing times.”

And further opposition to the strategy came from the California-based IT consulting firm Bristlecone. “Tariffs or the potential for tariffs increase uncertainty throughout the supply chain, potentially stalling deals, impacting the sourcing of raw materials, and prompting higher prices for consumers,” Jen Chew, Bristlecone’s VP of Solutions & Consulting, said in a statement. “Tariffs and other protectionist economic policies reflect an overarching trend away from global sourcing and toward local sourcing and production. However, despite the perceived benefits of local operations, some resources and capabilities may simply not be available locally, prompting manufacturers to continue operations overseas, even if it means paying steep tariffs.”

Days after tariff threats by the Trump Administration against Canada and Mexico were paused for a month, imports at the nation’s major container ports are expected to remain high, as retailers continue to bring in cargo ahead of the new deadline and to cope with elevated tariffs on China that did occur, according to the Global Port Tracker report released today by the National Retail Federation and Hackett Associates.

Part of the reason for that situation is that companies can’t adjust to tariffs overnight by finding new suppliers. “Supply chains are complex. Retailers continue to engage in diversification efforts. Unfortunately, it takes significant time to move supply chains, even if you can find available capacity,” NRF Vice President for Supply Chain and Customs Policy Jonathan Gold said in a release.

“While we support the need to address the fentanyl crisis at our borders, new tariffs on China and other countries will mean higher prices for American families,” Gold said. “Retailers have engaged in mitigation strategies to minimize the potential impact of tariffs, including frontloading of some products, but that can lead to increased challenges because of added warehousing and related costs. We hope to resolve our outstanding border security issues as quickly as possible because there will be a significant impact on the economy if increased tariffs are maintained and expanded.”

Hackett Associates Founder Ben Hackett said tariffs on Canada and Mexico would initially have minimal impact at ports because most imports from either country move by truck, rail or pipeline. In the long term, tariffs on goods that receive final manufacturing in Canada or Mexico but originate elsewhere could prompt an increase in direct maritime imports to the U.S. In the meantime, port cargo “could be badly hit” if tariffs on overseas Asian and European nations increase prices and prompt consumers to buy less, he said.

“At this stage, the situation is fluid, and it’s too early to know if the tariffs will be implemented, removed or further delayed,” Hackett said. “As such, our view of North American imports has not changed significantly for the next six months.”

U.S. ports covered by Global Port Tracker handled 2.14 million twenty-foot equivalent units (TEUs) in December, although the Port of New York and New Jersey and the Port of Miami have yet to report final data. That was down 0.9% from November but up 14.4% year over year, and would be the busiest December on record. For the year, December brought 2024 to a total of 25.5 million TEU, up 14.8% from 2023 and the highest level since 2021’s record of 25.8 million TEU during the pandemic.

Global Port Tracker provides historical data and forecasts for the U.S. ports of Los Angeles/Long Beach, Oakland, Seattle and Tacoma on the West Coast; New York/New Jersey, Port of Virginia, Charleston, Savannah, Port Everglades, Miami and Jacksonville on the East Coast, and Houston on the Gulf Coast.

Industry groups across the spectrum of supply chain operations today are pushing back against the Trump Administration plan to apply steep tariffs on imports from Canada, Mexico, and China, saying the additional fees are taxes that will undermine their profit margins, slow their economic investments, and raise prices for consumers.

Even as a last-minute deal today appeared to delay the tariff on Mexico, that deal is set to last only one month, and tariffs on the other two countries are still set to go into effect at midnight tonight.

Once new U.S. tariffs go into effect, those other countries are widely expected to respond with retaliatory tariffs of their own on U.S. exports, that would reduce demand for U.S. and manufacturing goods. In the context of that unpredictable business landscape, many U.S. business groups have been pressuring the White House to pull back from the new policy.

Here is a sampling of the reaction to the tariff plan by the U.S. business community:

American Association of Port Authorities (AAPA)

“Tariffs are taxes,” AAPA President and CEO Cary Davis said in a release. “Though the port industry supports President Trump’s efforts to combat the flow of illicit drugs, tariffs will slow down our supply chains, tax American businesses, and increase costs for hard-working citizens. Instead, we call on the Administration and Congress to thoughtfully pursue alternatives to achieving these policy goals and exempt items critical to national security from tariffs, including port equipment.”

Retail Industry Leaders Association (RILA)

“We understand the president is working toward an agreement. The leaders of all four nations should come together and work to reach a deal before Feb. 4 because enacting broad-based tariffs will be disruptive to the U.S. economy,” Michael Hanson, RILA’s Senior Executive Vice President of Public Affairs, said in a release. “The American people are counting on President Trump to grow the U.S. economy and lower inflation, and broad-based tariffs will put that at risk.”

National Association of Manufacturers (NAM)

“Manufacturers understand the need to deal with any sort of crisis that involves illicit drugs crossing our border, and we hope the three countries can come together quickly to confront this challenge,” NAM President and CEO Jay Timmons said in a release. “However, with essential tax reforms left on the cutting room floor by the last Congress and the Biden administration, manufacturers are already facing mounting cost pressures. A 25% tariff on Canada and Mexico threatens to upend the very supply chains that have made U.S. manufacturing more competitive globally. The ripple effects will be severe, particularly for small and medium-sized manufacturers that lack the flexibility and capital to rapidly find alternative suppliers or absorb skyrocketing energy costs. These businesses—employing millions of American workers—will face significant disruptions. Ultimately, manufacturers will bear the brunt of these tariffs, undermining our ability to sell our products at a competitive price and putting American jobs at risk.”

American Apparel & Footwear Association (AAFA)

“Widespread tariff actions on Mexico, Canada, and China announced this evening will inject massive costs into our inflation-weary economy while exposing us to a damaging tit-for-tat tariff war that will harm key export markets that U.S. farmers and manufacturers need,” Steve Lamar, AAFA’s president and CEO, said in a release. “We should be forging deeper collaboration with our free trade agreement partners, not taking actions that call into question the very foundation of that partnership."

Healthcare Distribution Alliance (HDA)

“We are concerned that placing tariffs on generic drug products produced outside the U.S. will put additional pressure on an industry that is already experiencing financial distress. Distributors and generic manufacturers and cannot absorb the rising costs of broad tariffs. It is worth noting that distributors operate on low profit margins — 0.3 percent. As a result, the U.S. will likely see new and worsened shortages of important medications and the costs will be passed down to payers and patients, including those in the Medicare and Medicaid programs," the group said in a statement.

National Retail Federation (NRF)

“We support the Trump administration’s goal of strengthening trade relationships and creating fair and favorable terms for America,” NRF Executive Vice President of Government Relations David French said in a release. “But imposing steep tariffs on three of our closest trading partners is a serious step. We strongly encourage all parties to continue negotiating to find solutions that will strengthen trade relationships and avoid shifting the costs of shared policy failures onto the backs of American families, workers and small businesses.”

Businesses are scrambling today to insulate their supply chains from the impacts of a trade war being launched by the Trump Administration, which is planning to erect high tariff walls on Tuesday against goods imported from Canada, Mexico, and China.

Tariffs are import taxes paid by American companies and collected by the U.S. Customs and Border Protection (CBP) Agency as goods produced in certain countries cross borders into the U.S.

They are typically intended to discourage businesses from purchasing goods made in targeted countries. But alternative supplies of those materials can be hard to find. So until new supply chains are established and factories are built to provide the same goods from new sources, U.S. companies face the stark choice of either swallowing the new taxes themselves or else passing the increased cost onto U.S. consumers in the form of inflated prices, experts say.

In a last-minute deal announced on Monday, leaders of both countries said the tariffs on goods from Mexico will be delayed one month after that country agreed to send troops to the U.S.-Mexico border in an attempt to stem to flow of drugs such as fentanyl from Mexico, according to published reports.

If the deal holds, it could avoid some of the worst impacts of the tariffs on U.S. manufacturers that rely on parts and raw materials imported from Mexico. That blow would be particularly harsh on companies in the automotive and electrical equipment sectors, according to an analysis by S&P Global Ratings.

However, tariff damage is still on track to occur for U.S. companies with tight supply chain connections to Canada, concentrated in commodity-related processing sectors, the firm said. That disruption would increase if those countries responded with retaliatory tariffs of their own, a move that would slow the export of U.S. goods. Such an event would hurt most for American businesses in the agriculture and fishing, metals, and automotive areas, according to the analysis from Satyam Panday, Chief US and Canada Economist, S&P Global Ratings.

To dull the pain of those events, U.S. business interests would likely seek to cushion the declines in output by looking to factors such as exchange rate movements, availability of substitutes, and the willingness of producers to absorb the higher cost associated with tariffs, Panday said.

Weighing the long-term effects of a trade war

The extent to which increased tariffs will warp long-standing supply chain patterns is hard to calculate, since it is largely dependent on how long these tariffs will actually last, according to a statement from Tony Pelli, director of supply chain resilience, BSI Consulting. “The pause [on tariffs with Mexico] will help reduce the impacts on agricultural products in particular, but not necessarily on the automotive industry given the high degree of integration across all three North American countries,” he said.

“Tariffs on Canada or Mexico will disrupt supply chains beyond just finished goods,” Pelli said. “Some products cross the US, Mexico, and Canada borders four to five times, with the greatest impact on the auto and electronics industries. These supply chains have been tightly integrated for around 30 years, and it will be difficult for firms to simply source elsewhere. There are dense supplier networks along the US border with Mexico and Canada (especially Ontario) that you can’t just pick up and move somewhere else, which would likely slow or even stop auto manufacturing in the US for a time.”

If the tariffs on either Canada or Mexico stay in place for an extended period, the effects will soon become clear, said Hamish Woodrow, head of strategic analytics at Motive, a fleet management and operations platform. “Ultimately, the burden of these tariffs will fall on U.S. consumers and retailers. Prices will rise, and businesses will pass along costs as they navigate increased expenses and uncertainty,” Woodrow said.

But in the meantime, companies with international supply chains are quickly making contingency plans for any of the possible outcomes. “The immediate impact of tariffs on trucking, freight, and supply chains will be muted. Goods already en route, shipments six weeks out on the water, and landed inventory will continue to flow, meaning the real disruption will be felt in Q2 as businesses adjust to the new reality,” Woodrow said.

“By the end of the day, companies will be deploying mitigation strategies—many will delay inventory shipments to later in the year, waiting to see if the policy shifts or exemptions are introduced. Those who preloaded inventory will likely adopt a wait-and-see approach, holding off on further adjustments until the market reacts. In the short term, sourcing alternatives are limited, forcing supply chains to pause and reassess long-term investments while monitoring policy developments,” said Woodrow.

Editor's note: This story was revised on February 3 to add input from BSI and Motive.

AI is the issue of the age. A platform for transformation and a putative cure for all problems, business leaders hope that AI will make everything better. But heading into 2025 IT needs to show return on AI investment whilst grappling with issues of data, infrastructure, skills and compliance. What are global IT buyers looking for when it comes to artificial intelligence projects in 2025? Our global panel of editors discuss these issues in our latest Global Tech Tales podcast. Panelists include Matt Egan, Global Content & Editorial Director at Foundry; Marcus Jerräng, Editor in Chief, Computer Sweden; and Xiou Ann Lim, Editorial Director of ASEAN for CIO and CSO. This episode is sponsored by HPE, the global edge-to-cloud company built to transform your business. Find out more at hpe.com.

Register Now

By Matt Egan, Global Editorial and Content Director

For the past several years in many organizations AI has been seen as a potential panacea for a wide range of problems or opportunities. Projects have been greenlit and funding found, based on what AI may be able to do. Now pilot fatigue has set in.

IT leaders tell us that aimless experimentation is out. Reports around failure rates of 50% or more have many organizations shifting AI investments toward more targeted business use cases. It’s no longer “what can AI do?” it’s about “what can an AI project do for us – now?”.

Not so much “show me the money,” but instead “show me the return on investment.” It’s a huge opportunity and a challenge that IT leaders have faced before with cloud and then digital transformation. The difference here revolves around the “race to return,” given the new hype around AI, combined with the changing economy and competitive landscape, among other things.

Assuming you have a good idea of what your organization needs to do and how AI could help, there are 5 key considerations to keep in mind.

IT leaders fortunate enough to work in an organization with a coherent AI-enabled strategy will be able to demonstrate real business value in 2025. But finding the right people and technology to support sustainable success must take center stage to ensure success.

00:00 Hi, I’m Matt Egan, as we’ll discover from our conversation today, the world is focused on the possibilities of AI. But what should you focus on your data? Because without it, there is no AI. With HPE, help make your data AI ready and uncover hidden patterns and trends, gain insights for better products and performance. Together, we can see more than possibilities. So you see success. Hewlett Packard, enterprise, unlock ambition. Hi everybody. Welcome to Global Tech Tales. What buyers want. I’m Keith Shaw here to moderate a discussion with other editors from around the world about technology and leadership topics. Joining me on today’s show. Matt Egan, he is the global content and editorial director at Foundry, and he is also representing the UK, and he is myco-host. Ann Lim, editorial director for CIO, CSO and Channel Asia in Singapore, and Marcus Jerräng. He is the editor in chief of Computerworld Sweden, representing Sweden and welcome everyone. Hello. Thank you very much. Hello. All right, so we’re going to talk about AI priorities in this episode. And you know, we’re in 2025 now, and I’m sure that CIOs and other IT leaders have got this huge, huge To Do List, especially when it comes to either artificial intelligence or generative AI. And there was an article recently in cio.com that talked about a lot of the different priorities, and their take was that play time was over, and it’s time to get practical, so that you know their big thing was moving from pilot to production. But we’re also seeing other priorities from from different from different organizations. I’m just going to run down the list really quick, and then I want to ask the panel about some of their impressions and what they’re hearing from their their you know, their colleagues in their parts of the world. So in addition to moving from pilot to production with a lot of the generative AI

products and projects, we’re also seeing exploring new technologies from AI agents, we’re also hearing about new technologies such as reasoning AI, new models that are out there ramping up and hiring or upskilling existing employees, it can be a priority focusing on the ROI cost of effectiveness of AI deployments. You know, are the are the CFOs starting to get involved with all of this money that’s being spent? And then finally, also cleaning up data, or finishing up previous data projects. There’s a lot of other statistics that we start off with the show here. And for example, there was an IDC report basically saying that 44% of marketing leaders and 42% of contact center leaders say the lack of skilled employees is the greatest barrier to successfully leveraging AI. So it feels like upskilling would be a huge priority. So I want to, I want to ask the panel, Matt, what are you hearing from your colleagues in the UK? Is this list of priorities, what you’re seeing as well, or are there other ones out there that are top of mind? I think it captures it, right? I mean, the reality is that AI has been around for many years, and even the generative AI hype is now half a decade old, right? And this is very much the year where the IT leaders I speak to are feeling the heat on the back of their neck, because organizations need to move from experimentation and projects to demonstrating real world value, the investments gone in, in terms of time, technology, even some hiring, although we should talk about that too. So I’m hearing a lot that the pressure is on for it to show the business leaders efficiencies, new products and services. And of course, what that then means is a whole other raft of things, each of which is worthy of its own discussions. Right? Return on investment, aligning and enabling the broader business strategy. It itself becoming an enabler of business strategy. It’s the point, and I hear this a huge amount, in which it leaders feel that they need to have their organizations prepped for whatever the future is going to be, right? So that means, yes, skills and mindsets within it, but also across the wider business. It means processes, right? How does an idea become a product? How does that develop? What are the metrics, the analytics, the it operating model to support but also enable these things? A big thing, a huge thing, I think, is infrastructure. A lot of it, leaders have been asked to support and lead on AI strategies without business leaders fully understanding the demands and connectivity, on storage, on security, and yeah, you mentioned it right? Data, if you’ve got bad input, you’ll get bad output. But how many organizations have the perfect, centrally accessible database? So I think it all rolls back into this idea that in 2025 play time is over, right? This is getting real, but the reality is, there are a lot of challenges that IT leaders feel, and in the UK, another one of those is the legislation piece. But I’d love to hear from the team, because I imagine we’re hearing similar but also different things in different parts of the world, okay? I want to bring in Ann on the conversation and and you represent Singapore, but you also cover a lot of going at what’s going on in China. So in that part of the world, what are the big priorities for AI? Firstly, Asia, and well, also Southeast Asia is fairly challenging to talk about, if I want to paint an accurate picture of what’s happening here.

On the one hand, we’re definitely seeing more organizations across Southeast Asia and Hong Kong, which is also a market that I cover, rolling out AI initiatives this year. And these are go lives right, which means they have already defined the scope, goals and criteria for success. They’ve established a project team and assigned roles, and more importantly, they have obtained the buy in and approvals from their stakeholders. And just to give you an idea of how rapidly this is happening, when we ran our CIO 100 awards last year, slightly more than half of the nominations described AI projects that were completed in the last two years. And I went back to the same group in January this year to ask about their predictions and goals for 2025

and almost everyone mentioned AI, Gen AI or AI agents. For example, Heineken has their first gen AI Lab in Singapore, which will explore and develop Gen AI solutions in house for the company on a global level. So we’re definitely seeing momentum, especially in industries like financial services, telecommunications and healthcare, which tend to be early adopters when it comes to new technologies anyway. But I have to point out that compared to other regions like North America and the advanced European economies. Many organizations here look at AI projects that focus on their unique business needs as well, and in many instances, this means infrastructure heavy needs, because when you look at the industries that dominate economic contribution to our region. You’re looking at manufacturing, trade, agriculture and real estate, as well as extractive industries like oil and gas. So the convergence of it and operational technology is an area of focus for many CIOs in this region.

Not only are they deploying AI for core business functions like HR, finance, sales and marketing, but they’re also looking at innovating their core business, for example, by creating digital twins for physical facilities like factories and oil rigs, deploying drones and autonomous vehicles at ports, and also using AI for quality control. But having said that, there are pockets of exception, like Singapore and Hong Kong that rely pretty heavily on the digital economy.

So

these are sort of AI leaders in the region, which widens the AI divide, all right, and Marcus, let’s swing over to Sweden and say, I think you were joking with us before that Sweden is falling behind, or they keep falling behind. And I don’t know if I actually believe that, but what’s going on in Sweden and other parts of Europe that when you talk to colleagues? Yeah, so most companies we talk to are still very much in the exploration phase, with the hopes of finding value this year and and the we starting to see some examples of companies moving from pilots to production. But still, it’s the on the one hand, we have the, you know, the chat bots and the AI assistance, that’s kind of the low hanging fruit for like customer service and and other type of consumer facing interfaces and stuff like that. So so that’s fairly that’s fairly common now,

and also you see some some generative AI in in certain verticals, like, like, the public sector is doing a lot of it. And we, I think we have interviewed two different law firms with lawyers who are very much into to partnering with their startups, for, for, for their,

yeah, some kind of customer service also, but more in total, on the other hand, we have, we have, maybe, where we see more action is in the classic AI with the machine learning stuff.

You often hear Swedish IT leaders say, Oh, we’ve been doing AI for years.

And they talk about machine learning because they have been doing that for years, so, so that it’s not necessarily looking at the the more you know, the new hype technologies, but,

but

so there’s certain, certainly an interest there, but we, yeah.

Are falling behind. We don’t really see a widespread adoption of generative, a generative AI for for productivity, like CO pilots and white collar stuff. It’s, it’s, it’s kind of a mantra now that we’re falling behind, but, but the data is supporting it. Just last week, we had a study from from Boston Consulting Group saying that 18% of Swedish white collar workers use generative AI weekly, and that’s compared to 54% in the rest of Europe and 61% globally. So I mean, if you trust the data is there, we’re behind. But, I mean, there’s still a lot of interest. Well, I mean, that’s a really, that’s a really important thing to point out, is that that not all AI is equal. When you hear the word AI, I think you know, the hype is around generative AI, but again, like you said, machine learning and deep learning does still count as artificial intelligence. It’s just a different type, and a lot of it is built around manufacturing and some of those industries, especially when you talk about robotics and automation, I think with the four of us, you know, just just between the four of us, it feels like Asia is ahead of everybody else, because I was really surprised to hear that all of the companies that Ann was talking to, or at least 50% were already doing Big projects, and they were now looking to extract value of that. Is that fair to say? Ann, yeah. But I do have to add that, given that these are numbers from our awards program, I think any company that is lagging behind is not even going to throw their hat in. That’s true for that. Yeah. So we might be looking at, looking at the cream of the crop, yeah. And also, there’s a cultural imperative here, right? So, like, like, knowing and loving my friends in Sweden, right? Nobody wants to put their head above the parapet and sort of claim something that may not be fully true, right? Like, like, Sweden’s an incredible market because, because, you know, it’s very kind of process driven and value driven, and actually also extremely innovative, despite kind of working culture that, you know, the US, for instance, would see as being, you know, limited, like people work their hours, like people have good health care, like it’s, it’s kind of, it’s kind of, and yet And yet And yet. At the end of all of this, you know, more unicorns per capita in Sweden than in almost any other part of the world. So I suspect there might even be some under reporting there. And to Ann’s point, you know, the people who are going up for awards are going to over report like they’re actually crafting their message. But also it’s like, what the it is. Because, I mean, how radical and interesting is it that individual white collar workers are using a co pilot or something else like that. I mean, ultimately, it’s probably a bit of an efficiency, but it’s also a little bit of kind of hype and a little bit of a fad, right? Whereas, as both Marcus and Ann have spoken to like often, the kind of real value is found in,

you know, AI stroke machine learning, that has been around for a long time, but really is materially impacting a process like manufacture or and you were mentioning Hong Kong and Singapore, massive financial centers, right processing, processing a lot of data very quickly. It’s not the most exciting piece, but it might be the most impactful in when you’re looking for ROI at this point, if it’s one thing, the current hype around generator AI and the hype in general has allowed companies and people who know about this stuff in companies, to finally get some resources to look at these things,

do something with AI. And they say, Hey, we have this machine learning project that we haven’t had funding for, but now we can, now we can do it, and now we can start to brainstorm what we can do with our data and stuff like that. Then we, we maybe don’t use generative AI, we use machine learning instead. But it’s, it’s, it’s kind of fueled that internal conversation with with the topic here being AI priorities, it feels like that if there is a long list of to do’s, do you feel that the IT leaders and the CIOs out there can tackle all of them in the year? Or will they actually have to do a checklist and go, All right, we’re gonna prioritize one, two and three, and then maybe we can get to four or five and six later on down the road, or do you start to feel like they might be overwhelmed? I can speak a little bit to the the US and UK markets, which are the ones that I’m sort of closest to. And I think that the really smart leaders at this point are focusing on building the kind of infrastructure the IT department and the process around the whole organization to enable their organizations for a future that is somewhat uncertain. So the priority is you’ve got to show some return on investment today, but in doing so, build the tech stack that is going to allow you to continually innovate moving forward. Because nobody knows.

What impact

agentic AI is going to have, or some of the other kind of more exciting, newer technologies that you were talking about earlier. Keith really like but business leaders are going to ask more and more and so so again, the IT leaders that I speak to are really kind of savvy, is they understand that they’ve got to kind of show a win to keep this train rolling. But what they need to get to is a data center stroke cloud solution with connectivity that is secure for the future, right? Because as this compute gets more and more as we go into a quantum world, the threat gets even more extreme, and so like their priority, a kind of strategic level is in order to support those kind of ROI wins, what the future development of new products and services and internal processes to make sure that the tech stack, the infrastructure and the organization is there. But I do wonder if that is different in the very different markets that we see across, I mean, the huge wave of the world that Ann’s covering in Southeast Asia and also Northern Europe, where Marcus is, yeah, and do the the leaders in in Asia, do they have the same kind of priority lists, or are they better at basically prioritizing, you know, especially as as the wave of new technologies comes out, I mean, every other week you’ve probably got a new announcement of a new innovative technology or a new model or something like that. And sometimes in the US, I think companies tend to kind of sit on the fence and just wait to see how it all settles out. Someone, someone told me once that just for a generative AI project, you usually have to wait at least one year for it to go through all the legal parts of a project. So they are on the pace. Most of the US companies are usually on a pace of, alright, we’re going to do this project this year, and then we’ll see what happens next year, with with the rate of change happening with with innovation. It feels like a year is way too long. But I wanted to, you know, what are the feelings in Asia Pacific? Ann, well, when it comes to experimenting, they’re really quite quick to adopt new types of technology.

But once again, the rollout is a different story, right? And to Matt’s point, some of them are looking at quick wins. You know,

if there is any pressure from the board or the CEO, because AI is such a familiar technology and easy technology for them to wrap their heads around, unlike network transformation or the cloud, sometimes there is a pressure to achieve quick wins. And so, Keith, you also talked about this earlier. What are we talking about when we talk about AI, right? Or the deployment of AI, many companies are actually using Microsoft’s co pilot as a soft entry into that.

It’s, you know, it’s, it’s used, why?

Because of the word soft. And it’s just, yeah, there’s not a, there’s not a lot of fans here of the copilot stuff. But maybe it’s just me that I’m saying this, right? They are marketing copilot quite aggressively in Asia. You know, it’s such a fragmented market. They’re flying in CIOs from Hong Kong, Vietnam into Singapore to, you know, run demos and have consultation sessions, quick wins and also partnerships with the vendors is a really important point in Asia,

just because of, you know, the skills gap and the resources and sometimes not having modern infrastructure in place. Yeah, it feels like we’re in the time where, you know, Marcus spoke to this and and spoke to this, where you, if you want to get something funded, being AI adjacent is helpful, and if you want, you know, if you want to experiment, being AI adjacent is helpful. And I definitely think, from the vendor side, you know, we talked about copilot, which is a totally legitimate tool, and it’s heavily marketed here, for sure. But there is also an element whereby

the vendors know that IT leaders are looking for AI labeling in everything they buy, because it helps them with their internal conversations as well. Certainly helps the companies when it comes to funding as well. You know, all of these startups, they just plop in the word AI into all of their slide decks, and then all of a sudden they get millions and millions of dollars. But that’s a little bit of a snug and cynical comment from from me as well. I want to talk about AI agents. It seems like that’s the big new technology that everyone’s going to be chasing starting this year in 2025 but I’m sure going going on there is, are you seeing hype around AI agents in your part of the world, Marcus, let’s start with you, not with like senior leaders. No, of course there’s a general general talk about it. But I think, as for for AI stuff, I think it should be quite interesting once the talk.

G is maturing because sedan has been very big on RPA and stuff like that. The you know, the automation stuff and

companies have already, several years ago, begun to treating the robots like employees and stuff like that. So the robotics part is something I think that they want to look at the automations,

but then you’ll have to see how good are these agents? What can they do? How much do they miss? That’s the good question. So yeah, and you mentioned AI agents earlier. Again, is it something where the rest of the world could look at, you know, the Asia Pacific area and go, Yeah, this is, this is, this is who we’re gonna put the spotlight on you guys to see what happens. There are lots of conversations around AI agents, but it’s, to be honest, it’s still very early days here in terms of, you know, execution and adoption, we’re seeing the deployment of AI agents, mainly in CRM so contact centers, sales and marketing. I saw a Salesforce demo last year for their AI sales agents, you know, that could address customer queries in real time by extracting data from companies website. I think it would be a really useful I think it would be really useful as a tool for sales reps, but

in terms of the adoption, I think it’s going to depend a lot on the price point and also the product roadmap. Yeah, and Matt, what about the UK? Well, I was just going to say, I think so UK, and I’ll include the US in this as well. Like with the larger kind of organizations, there’s definitely this conceptual idea of agentic AI areas in which AI can support, not just by speeding up a downstream task, but work alongside the human workforce on end to end tasks and processes. It’s kind of table stakes. And as Ann mentions, in the kind of customer relationship management, it’s kind of table stakes now that that AI is that first level of filter, and so there’s definitely a level of interest in, can an agent take things further? Can, can it, you know, can it work with more nuance and and and move a customer through multiple processes? I’m not sure it’s fully proven out, to be honest with you. And then you have lots of startups who are talking about agents, talking to agents, and kind of a level of almost creativity within the end to end task flow that an organization has to do. And I heard one startup leader in answer to a question recently, and one was kind of asked, how effective would it be, and sort of, how would it develop? And said, We don’t know. And I think there’s an element of that definitely out there. It’s like, yeah, conceptually agents, you know, whether it be customer facing or even in things like developing code or managing and monitoring hardware systems or analytics, like they could take things a step further than simply, you know, automating a task. But I do also feel like we’re in that, that situation where I haven’t seen a killer app development at this point, and I think there’s a level of nervousness around unleashing agents in live. That’s a great that’s a great word. Matt, nervousness, I was going to say fear or concern with where you can almost take the human out of the loop. I know that they’re especially with the early days of generative AI, in the chat bots, there was this feeling of, okay, we’ll just let the chat bot do its thing. And then, and then there were stories all over the place of, you know, chat bots that were, you know, selling cars for $1

there was some, some big, high profile mistakes that a lot of the early chat bots made. And I think, and I think that they’re, they’re right to be nervous and concerned, especially if you’re trying to give up, you know, do you’re trying to automate a process, but you still have to have some humans looking at it at some point and to what end right, and what is the impact on those humans? I mean, really interesting part of this conversation is that we’re representing four very different locations in terms of approach, and representing multiple different locations in terms of approach to employing human beings and like building careers and and the legislation around that, but also the culture around that. And I think, you know when we when we talk only about customer relationship management, you know, it’s kind of table stakes in the UK, specifically to expect that you’re not going to speak to a human and so you’ve raised something through several layers. And to some extent, people like that, right? People actually prefer to deal with a machine than with a human being. Well, there is a point by which, but there is a point at which that becomes damaging, and it’s worse than not doing service. And then, similarly to your point, Keith, all of these things need some level of human guidance and interaction, but then you’ve got to factor in those humans who work for your organization, working with agents. What’s there at.

Experience, motivation, career development, and also, if these agents are taking on very specific technical tasks, are you losing the human ability to do and influence those tasks? So I think, related to the skills piece, and also legislation, there’s a huge amount to unpick there. And again, I’m seeing conceptually, a lot of interest, but I’m not seeing many people sort of going both feet in to really push things forward with agentic. Ai, yeah, on the agent side of things too. It feels like that a lot of companies are going to experiment for internal usage, at least initially, before they start unleashing these agents onto either their customers or the consumer side. I don’t, I don’t think we’re going to see any consumer side agents until they know, like the companies that are making them, until they know that they’re that they’re going to be safe and effective. So I think for a while at least, we probably won’t see a lot of examples to help pipe the technology until these companies know that they’re effective. Are you seeing similar things in your parts of the world? Marcus and Ann? I think there are a couple of things to Matt’s point. It’s certainly not going to replace jobs anytime soon, for a few reasons. So one is that

many of these AI agents are created elsewhere. And so there is that there are cultural differences, and you know, the data that goes into it, as well as what sort of learnings it takes from the companies here. The second thing is that in Southeast Asia, labor costs are still fairly low, which means companies might not see the imperative from a cost savings perspective, right for them, it’s still cheaper to employ, say, 1500 employees than to buy a software or a piece of technology like AI agents. Yeah, Marcus. How about about over in Sweden? This is one of those issues that Matt was alluding to that we don’t really talk about in the open when it’s when it’s not really done, because it’s very sensitive with terms of workers rights and employment stuff and stuff like that. And in Sweden, that’s a very, very big issue. You had some, a couple of

like, more startup like companies going out and saying that we’re going to cut, cut costs and cut stuff because of AI and AI agents, maybe customer service and stuff like that. But otherwise, I don’t think it’s something you’re going to hear about until it’s like, really here, because then you’re gonna gonna have the conversations with the unions and stuff like that. Just now starting to say that, Oh, in a couple of years, we’re gonna do this that’s gonna just create some so much uncertainty. And

so I don’t think we’re really gonna hear it until it’s it’s for real. Okay, I want to move on. This is something that Matt brought up to you. Mentioned the skills gap and I and again, there was when we started the show, we were talking about

that the greatest barrier is the lack of skilled employees. Are you? Are you seeing skills gaps in your part of the world as well, and how much of a priority should companies place on making sure that they can either find people that are out there that know this stuff or UPS, you know, are we going to just see upskilling of existing employees, I think, a combination of all of the above? So I, when I, when I spoke earlier about, you know, preparing the organization for the future organization. I see a lot of this in the US right now. There’s this really strange conflation of factors, where there’s a lot possibly the most ever IT professionals unemployed, and there’s a lot possibly the most ever roles unfilled within it. So there’s a mismatch between skills and experience and what’s required, and in part, at least, that is down to and there’s multiple factors, and that’s not just around AI, but I think one of the factors here is that the future of information technology doesn’t look like the past, and therefore it’s hard to hire people who have the specific set of skills and experiences that your organization needs, not least because you don’t know what your organization needs. So I do think there’s some real key hiring, and if you’ve got experience of leading successful, AI driven projects, you can kind of punch your own ticket at this point. But equally, there’s a real opportunity around hiring smart, flexible, innovative people with good core skills who want to and are willing to develop with an organization which in turn just one final point is that’s not how organizations within the UK and the US have been behaving over the past five to 10 years. Right? They’ve actually been reducing, uh.

Workforce, and they’ve been reducing costs. So it’s kind of a mindset shift to go to your business leadership and your board and say, Actually, we need to increase the number of people we’ve got. We need to develop and build their careers. And we don’t entirely know what the ROI is going to be at this point, but it’s going to be related to working with new technologies in AI. So I think it’s a very interesting and challenging situation for both hirers and also individuals. Yeah, and is there a skills gap in Asia as well, or is it not as high a priority as some of the other things on our list? There’s definitely a gap in Asia. I think it starts also from education, between tertiary education and joining the workforce because of how rapidly technology is advancing. You know, whatever modules that they might introduce now into tertiary education systems might become irrelevant in four years time when these students graduate and join the workforce.

Another thing to think about is, I think in Asia,

a lot of the skills are acquired on the job.

So I mentioned the widening AI divide in Asia earlier, right? And this isn’t just about the competitive advantage of businesses relative to their peers, but it strongly affects talent as well, because in innovative companies that adopt new technologies fairly quickly, employees ride a gradual AI wave, they have the opportunity to learn on the job. So it feels like a gentler evolution rather than a revolution. So you could imagine, you know, someone spending 10 years in an organization that is a technological laggard, right, a Luddite, if you must, and by the time they leave, they could find themselves in a job market where everyone else has moved on and the process of upskilling outside of on the job training costs, time and money. So that’s one thing to look at, but there are also

examples of public policies and governments stepping in in Asia to alleviate the problem. So in Singapore, for instance, the government created a statutory board called Skills future and allocated a budget to ensure that every citizen 25 years and above, are given $500 annually to enroll in training courses and things like work study programs, and This at the mid could be at the mid career level right to help the workforce remain relevant. But of course, not all governments can be relied upon for such initiatives, and we probably shouldn’t as well. Yeah, Marcus, it feels like Europe would be leading the charge in the upscaling space as well, given some of the labor concerns that they have about potentially losing this those jobs. Do you see that like a greater, a greater need for

UPS or training? Or are they still looking, you know, to just find people that are out there already.

I think they, they would prefer to find people, but we there are no people to find. I mean, looking at Sweden, we’re a small country. We don’t have enough professionals, as it is certainly not in AI. So, so what we do is we either hire our consultants, go to the one of the big consultancies, or the big, big vendors, like the Microsofts and the Googles and the Amazons,

or we, we train internally and upskill.

And we talked to IKEA just the other week, which was quite interesting, because they have, they have done one big like, general AI education for like, 30,000 employees with the Gen AI basics and stuff like that, but they also do

10 to 15 select people from different parts of the of the business go on a one year full time training in data analytics and AI Just, just to to, like, bring up the skill levels and let those people go out to their respective departments and, like, teach them how to, how to do this stuff. So that’s, that’s, that’s a great approach. And that’s the approach that that I think would will work for for a country like ours. Yeah, that’s, that’s really impressive. I you know, 30,000 people, that’s, that’s really cool, that they’re doing that. One of the things that that’s come up recently in here, in the US, is a lot of surveys that people are saying, the employees at a lot of these companies are like, they actually want AI, they want these tools. They they are asking their.

Companies for these tools, and the companies have not deployed them yet. So not only are they probably looking for upskilling and training, they’re also looking for the tools from their company. So we’ve got a couple of podcasts coming up that are good is going to discuss that trend as well. That was pretty surprising that like that the a lot of the companies here in the US were were holding back, probably because of these concerns around accuracy and and, you know, security and things like that, that those were taking priorities before they started deploying it for to all the employees. Matt, you brought up another point I wanted to bring up before we end the show, which was the legislation. Because it, again, a lot of different countries in the world have a different approach around AI legislation. I want to just say in the US that it was pretty much a hands off approach. There were some during the Biden administration, there were some executive orders that were launched around AI, but for the most part, US usually takes a hands off approach, with a lot of businesses in AI, but that’s certainly different from what we see in Europe. And I just wanted to see how much of the legislation is going to be impacting on what decisions people make around the ai ai priorities. I mean, in Sweden, it’s already impacting because, because the legislation, the AI Act, is not it’s it’s still a year until it kind of hits it’s hard, but what you see in the conversations everything is about creating safe, responsible, secure, AI so, so even if we don’t know exactly how the legislation is going to work and What the penalties are, and stuff like that. We have some idea, but it’s going to be a future issue. You still. This risk averse mindset has already set in, because every, almost every IT leader we talk to say we need to build safe and responsible and ethical. Ai,

I would say. So that’s a big thing here. It’s on, it’s top of mind over there. And what are you what are you hearing about? Is there a lot of legislation that goes on out where you are. I think when it comes to regulation, we tend to be followers, especially compared to the EU. So Southeast Asia has mainly taken a light touch and voluntary approach to AI regulation. China is a bit more prescriptive, because they want to protect their national interests. Most of the economies here are also still developing, and even the more mature ones, like Singapore, Hong Kong, they want to remain business friendly, so innovation is highly encouraged, but at the same time, they do have broader regulations like cyber security legislation, which means that that encourages private organizations to kind of Self police for now when it comes to AI,

I ran a round table discussion last year, this was in Perth, Australia,

around cyber security. And one of the attendees mentioned that his policy when it comes to you know what goes into Gen AI and chat GPT is that if you don’t want it, if you don’t want to see that information in headlines, then it shouldn’t go into chat GPT.

Right, right, right, exactly. And I think the rest of the world is basically saying to the EU, go ahead. We’ll just follow you guys, because it feels like there’s no one else that that is taking a lead on this. Matt, any thoughts? Yeah, I mean, from a UK specific perspective, I could fill an hour talking about this subject, because we’re not in the EU and that has that is here in that I actually think some of what Biden’s administration did was pretty smart, actually, like in that they tried to set very broad guard rails and allow for innovation within there. The UK government, very recently, has kind of staked a lot on AI being a driver for the economy, because the economy is in the toilet, at least in part, because we left the EU and that’s a real challenge when your biggest trading partner, just across the sea is no longer you’re no longer part of that organization. I think we think, for the UK perspective, we’re kind of a little bit caught between a rock and a hard place. I think in general, with most legislation, the honest truth is we follow the EU and that’s a sensible thing to do. Just map to it exactly as Singapore does like around that kind of legislation, but I think also there is this kind of desperate desire to be seen as an innovator, and so therefore deregulate some areas in order to drive

drive that economic impact forward. Honestly, the challenge around it is, as is always the case of government.

Of all stripes, like they’re kind of behind the curve, so they’re trying to legislate for something that’s already kind of moved forward. So I would say, Watch this space around how legislation is going to impact AI in the UK over the next five to 10 years. All right, so for the end of the show, we usually have a vote where our panelists give a yes or no answer, but if you want to, I’m allowing for maybes as well, or it depends. Sometimes that’s, that’s a great answer. But for this, this particular panel, I want to know, will 2025 be the year that most companies begin producing actual AI projects, or is it going to be another year of kicking the tires to low hanging fruit, just from your perspective? So Marcus, why don’t you start us off? I would say not most, but more companies that I would say it’s, it’s, it’s gonna, it’s starting to take off now, and when it does, it’s gonna spread. I think, yeah, okay. And I think it’s going to be a yes and no for Asia, because for just so fragmented. So definitely, those who have the budget and the stakeholder buy ins are going to look to do more with AI and the rest of them probably not at all. Disappointed me. I agree with both of my colleagues. It’s always better when we have some sort of argument. I think I think yes more definitely to Marcus’ point. I also think that

even those organizations that aren’t doing so will try and pretend they are, because I think, I think there’s a certain amount of kudos in being seen to be successfully implementing AI. I definitely see it’s going to be an acceleration, but I don’t think it’s a binary yes or no thing, because I don’t think all organizations will successfully implement. AI would love to be the, I would love to be the outlier on this, but I’m going to agree with everybody else. I think the more is, the is the great word, it’s, it’s the people that have already the companies that have already done it, will continue to do more, and they’ll and they’ll move towards that, that project space, those have been that have been sitting on the fence, will finally get on board and go, Okay, we’ve had two to three years of this stuff now. It’s legit. It’s not like some other technologies that come and go. They’re gonna go at least all in with some some some low hanging fruit there. Maybe it’s just not me. I have to come up with better yes or no questions for future episodes. So all right, I want to thank everybody for being on the show again. We had different time zones here, so this was a nice experiment. So thank you all for participating, and we’re going to be back next month with more global editors, and we’re going to be talking about risk management in the security space. So that’s all the time we have for the show today. Feel free to add any comments you have below, and make sure you check out our other tech talk shows, such as today in tech, cio leadership live and demo, if you are interested in seeing B to B product demonstrations. I’m Keith Shaw, thanks for watching.

Sponsored Links

Searching for your content…

In-Language News

Contact Us

888-776-0942

from 8 AM – 10 PM ET

Feb 18, 2025, 15:08 ET

Share this article

ARLINGTON, Va., Feb. 18, 2025 /PRNewswire/ — Today Bloomberg Law announced a replay of its virtual special event, “Generative AI for Law: What’s Here, What’s Next, What’s Possible.” To learn about the future of legal tech and see how AI-powered innovations can elevate legal practice on demand, visit https://aboutblaw.com/bhfT.

Bloomberg Law’s legal analysts share four takeaways from examining the trends around the use of AI in the legal field:

Bloomberg Industry Group Chief Product Officer Bobby Puglia highlights Bloomberg Law’s guardrails system, ensuring that the platform’s generative AI features are safe to use and trust. Guardrails validate the input and output of the model to make sure the answers provided are acceptable. Puglia also explains Bloomberg Law’s unique Innovation Studio, which allows the Bloomberg Law product team to put prototypes of generative AI product features in front of practitioners who experiment with them, test them out, and provide feedback throughout the development process.

Bloomberg Law’s product development team shares an inside look at the platform’s newest AI tools, Bloomberg Law Answers and Bloomberg Law AI Assistant. With Bloomberg Law Answers, legal professionals can get quick, precise answers to their legal questions, drawing from a comprehensive range of legal sources available on the Bloomberg Law platform. Bloomberg Law AI Assistant is a chat-based research tool that allows users to generate summaries of legal documents, as well as ask targeted questions to identify specific information from those documents. Bloomberg Law Answers and Bloomberg Law AI Assistant are available within the Bloomberg Law platform at no additional charge.

“As we look ahead at the future and our AI product roadmap for this year, we see a lot of opportunity to move from creating workflow efficiencies for users to actually improving the quality of their work product,” said Puglia. “We’ve already started building drafting solutions for transactional attorneys, and we plan to add litigation drafting solutions to assist customers with drafting motions, briefs, and more.”

About Bloomberg Law

Bloomberg Law combines the latest in legal technology with workflow tools, comprehensive primary and secondary sources, trusted news, expert analysis, and business intelligence. For more than a decade, Bloomberg Law has been a trailblazer in its application of AI and machine learning. Bloomberg Law’s deep expertise and commitment to innovation provide a competitive edge to help improve attorney productivity and efficiency. For more information, visit Bloomberg Law.

SOURCE Bloomberg Law

Today Bloomberg Law announced the final month of submissions for the inaugural issue of Bloomberg Law’s Unrivaled, a new award celebrating leading…

Bloomberg Law today announced that it has named 10 finalists in its Law School Innovation Program, now in its third year. The program aims to…

Artificial Intelligence

Computer & Electronics

New Products & Services

Do not sell or share my personal information:

Home » Crypto & Blockchain »

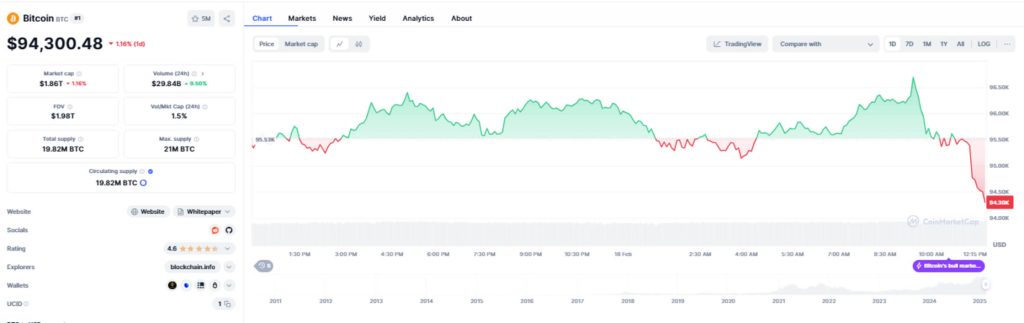

Bitcoin’s struggles below $100k stretched into the third week of February 2015 after the third straight day of losses sent it tumbling towards $95,000.

The disappointing price action rallies on despite growing interest among institutional investors.

Since losing grip of $100k on the first weekend of February 2025, Bitcoin has staged multiple – albeit unsuccessful rallies towards this price level.

Over the last 24 hours, the legacy coin has dipped by close to 2% from yesterday’s high of $98k to the intraday lows of $95,111, according to CoinMarketCap. This was the third day of straight losses, which saw it fall below the support level of $95,500 and dip further below the key resistance level of $98,000.

Over the recent past, a growing number of institutional investors have rushed to buy the dip. For example, Strategy (formerly MicroStrategy) recently acquired $720 Million worth of Bitcoin this month.

Bitcoin ETF inflows have also increased steadily for the first four weeks of the year. Multiple other companies have also started adding Bitcoin to their balance sheets, including Metaplanet – which recently acquired 269 BTC.

Investor and trader optimism towards the legacy digital currency has also been on the rise.

Bitcoin’s long-term forecasts are massively bullish, with the likes of Cathie Woods of Ark Investments stating that she expected the BTC price to rally towards $1.5 million by 2030.

The threat of an all-out trade war over Trump Tariffs has had the biggest impact on Bitcoin’s recent price action.

It has market-wide FUD, which explains why even the slightest bearish headline has had a huge impact on BTC prices.

It may even be attributed to the growing bearish trends towards Bitcoin seeing that the MACD histogram has not only been printing red bars but both the MACD Line and Signal line are in the negative territory.

The declining RSI of 39 represents fading bullish strength as Bitcoin approaches the oversold territory.

In addition to the Trump Tariffs, the cautious-optimistic FEDs as well as uncomfortable key economic data, like the CPI, which recently came in higher than expected has spooked investors.

Our premium members received real-time alerts on major crypto plays before they happened. Will you be ready for the next one?

⏳ Limited Spots Available – Secure Yours Now!

🔥 Get Instant Access Now

Download 50 crypto investing tips

Sam Ralph is a financial writer and researcher with over 10 years of market experience. Specializing in tracker funds and cryptocurrency, he combines disciplined research with actionable insights, helping investors navigate markets confidently. Sam’s expertise simplifies complex financial topics, empowering readers to make informed investment decisions.

Receive top notch forecasts for free.

*We hate spam as you do.

Precious metals market analysis including gold and silver price predictions. Crypto market analysis including highly accurate BTC ETH SOL XRP forecasts.

Copyright © 2024 InvestingHaven

Login to your account below

Fill the forms bellow to register

Please enter your username or email address to reset your password.

InvestingHaven.com honours your privacy. Read our Privacy Policy

Copyright © 2024 InvestingHaven

The Currency analytics

Cryptocurrency News – REAL News ® – TCAT

XRP, the digital currency connected to Ripple, is showing significant bullish signs in the market. A popular chart pattern, known as the Cup and Handle, has recently appeared on its price chart, and experts are speculating that this could drive the price of XRP up to $3.35, marking a notable local high for the asset.

The Cup and Handle pattern is one of the most widely recognized chart formations in technical analysis. It typically signals the potential for a price breakout following a consolidation phase. The pattern is made up of two key parts:

The Cup: This part of the pattern forms a rounded bottom, indicating that the price has moved downward, followed by a gradual upward recovery. This stage represents a consolidation period where selling pressure diminishes and buying activity begins to take over.

The Handle: After the cup is formed, the price usually consolidates again in the form of a small pullback or downward slope. This phase tends to have low volatility and forms the handle, which acts as a final stage before the price surges once the resistance is breached.

The Cup and Handle pattern is generally seen as a positive indicator, suggesting that once resistance levels are broken, the price is likely to see a sharp upward movement.

XRP is currently demonstrating clear signs of forming a Cup and Handle pattern, with the rounded bottom already in place. Well-known crypto analyst Ali Martinez has drawn attention to XRP’s price chart, pointing out the pattern’s formation and predicting that it could lead to a price surge.

According to Martinez, the key resistance levels for XRP are between $2.7 and $2.8. This zone corresponds with the upper boundary of the handle portion of the pattern. If XRP can break through this resistance, the next likely price target is $3.35. Such a move would represent a 28.8% increase from its current price of around $2.6.

Martinez further explains that a successful breakout above the $2.8 resistance level could trigger a new bullish phase for XRP, potentially pushing it toward the $3.35 mark.

A surge to $3.35 would mark a significant achievement for XRP, indicating that the Cup and Handle pattern has successfully played out. This price movement would also signal that XRP is gaining bullish momentum, potentially setting the stage for even higher price levels in the near future.

XRP has already demonstrated a positive price shift in recent days, gaining 9.6% in the past week after experiencing a drop of more than 14% the month before. This type of price fluctuation is common in consolidation phases and suggests that XRP may soon be ready to break out.

Beyond the technical analysis, XRP’s price is also heavily influenced by external factors such as the ongoing legal battle between Ripple and the U.S. Securities and Exchange Commission (SEC). The outcome of this case, which revolves around whether XRP should be classified as a security, has created some uncertainty in the market. However, analysts are hopeful that a resolution will bring clarity and lead to a price surge.

Ripple’s ongoing efforts to secure partnerships with major banks and the growing interest in blockchain technology also bode well for XRP’s future. Additionally, speculation about the potential approval of an XRP Exchange-Traded Fund (ETF) could add further momentum to the asset’s price.

XRP’s current technical chart pattern, coupled with positive market developments, points to an exciting future for the cryptocurrency. If the Cup and Handle pattern plays out as predicted, XRP could see a price surge to $3.35, representing a 28.8% gain from its current price. Investors and analysts alike are watching closely for a breakout above key resistance levels and are optimistic about the potential legal resolution for Ripple. With these factors in play, XRP’s price is well-positioned for future growth.

Mike T, an accomplished crypto journalist, has been captivating audiences with her in-depth analysis and insightful reporting on the ever-evolving blockchain and cryptocurrency landscape. With a keen eye for market trends and a talent for breaking down complex concepts, Mike’s work has become essential reading for both crypto enthusiasts and newcomers alike. Appreciate the work? Send a tip to: 0x4C6D67705aF449f0C0102D4C7C693ad4A64926e9

Get the latest Crypto & Blockchain News in your inbox.

By clicking Subscribe, you agree to our Privacy Policy.

Copyright © 2017-2023. The Currency Analytics

Get the latest updates from our Telegram channel.

While crime in Connecticut is trending down, animal cruelty crimes have increased by nearly 36% over the past year, according to the Department of Emergency Services and Public Protection (DESPP).

New data from the DESPP shows that there has been a 36.6% increase in animal cruelty crimes from 2023 to 2024.

Free 24/7 Connecticut news stream: Watch NBC CT wherever you are

Officials said the animal cruelty crime increase remained consistent throughout 2024.

A veterinarian we spoke with said many cases of animal abuse and neglect can be traced to the pandemic adoption surge.

“We were all so isolated, and I think sometimes some of that adoption didn’t come with the education of what’s involved with caring for our pets in that manner,” Dr. Andrea Dennis of Bloomfield Animal Hospital said.

Another vet said in many cases, people don’t understand how pets behave or how much pet care costs.

“Just like in our day to day lives with inflation, rising cost of living comes the rising cost of veterinary care,” Dr. Jacqueline Pino of Guilford Veterinary Hospital said.

Both urge people to take adoption seriously or to relinquish their pets to shelters or rescues.

The data also shows that serious offenses have gone down 14.1%, including a 44% decline in murder and 17.8% decline in rape.

Crimes against property rates have also gone down, including a 44% decline in fraud, a 19.6% decline in motor vehicle thefts and a 37.5% decline in arson.

But wire fraud reportedly had a 15.2% increase – with most of the crime happening in the first half of 2024.

“The news today is good. Most significantly, we are continuing the long-term trend of a safer state for Connecticut residents,” DESPP Commissioner Ronnell A. Higgins said in a statement.

To see a full breakdown of crime data in 2024, click here.