Bitcoin has crashed today, erasing the gains from the Christmas rally. Here’s how this may have been foreshadowed by social media sentiment.

On Christmas Day, Bitcoin came close to touching the $100,000 mark, but in the past day, the coin has seen a sharp reversal of trend as its price has collapsed toward the $95,000 level.

Like with any other price plunge, there are bound to be several factors contributing to the trend. One of these could potentially be the sentiment shared by traders on social media.

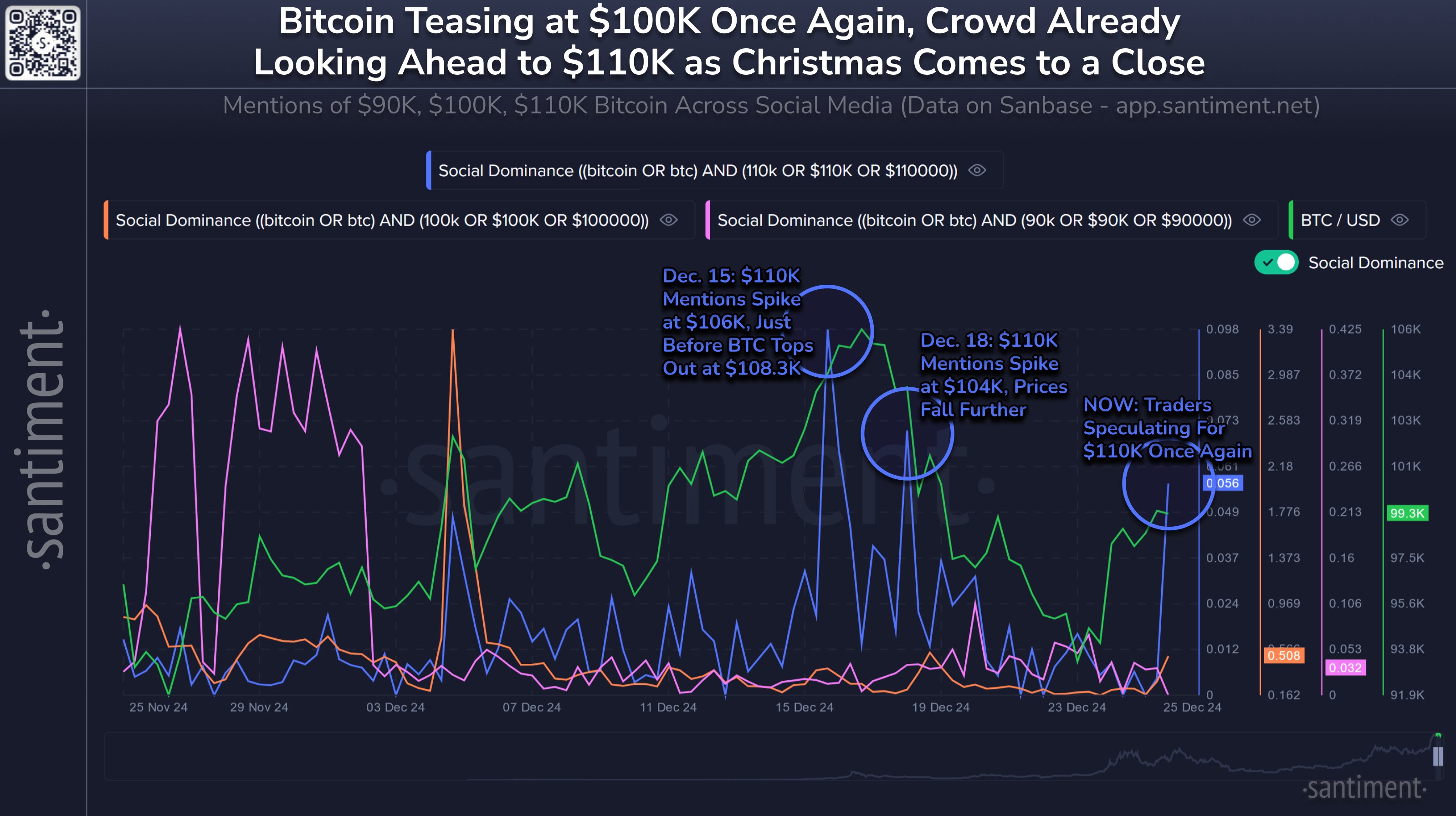

When BTC had rallied yesterday, the analytics firm Santiment had shared a chart that revealed how social media had been reacting to the run. The indicator cited by the analytics firm was the “Social Dominance.”

The Social Dominance keeps track of the percentage of the total social media discussions related to the top 100 cryptocurrencies that a given term or topic occupies.

Santiment has used this metric for gauging sentiment on the major social media platforms by applying Bitcoin and price-target-related terms to it. The price targets in question are $90,000, $100,000, and $110,000.

In the context of the recent rally, investors posting about the $90,000 target would naturally be bearish on BTC. Similarly, the posts containing $100,000 would reflect a neutral sentiment, and those with $110,000 would correspond to bullish optimism.

Now, here is a chart that shows the trend in the Bitcoin Social Dominance for these terms over the last month:

As is visible in the above graph, the Bitcoin Social Dominance for the $110,000 target spiked during the latest rally, implying the social media users were quite bullish about the run and expected it to continue until a new all-time high (ATH).

Historically, the cryptocurrency’s price has tended to move in a manner opposite to the expectations of the crowd. This probability of a contrary move taking place has also only gone up the more sure the traders have become about a direction.

As such, while some optimism may not prove to be bad for a rally, an excess of hype can make a reversal more likely to take place. From the chart, it’s apparent that the Social Dominance of the level had also spiked twice earlier in the month and on both occasions, BTC had ended up suffering price declines.

Given the past precedence, it’s not surprising to see that the latest price rally also ended up in failure after the traders on social media got overly excited about where the run could lead to.

At the time of writing, Bitcoin is trading around $96,100, down almost 4% over the last week.

For updates and exclusive offers enter your email.

Keshav is a Physics graduate who has been employed as a writer with Bitcoinist since June 2021. He is passionate about writing and through the years, he has gained experience working in a variety of niches. Keshav holds an active interest in the cryptocurrency market, with on-chain analysis being an area he particularly likes to research and write about.

Bitcoin news portal providing breaking news, guides, price analysis about decentralized digital money & blockchain technology.

© 2023 Bitcoinist. All Rights Reserved.