24-hour tracking of blockchain industry news and in-depth article analysis

Author: Frank, PANews

From the once-star public chain Fantom to today's Sonic Labs, 2024 is a year of drastic changes on this Layer1 chain: foundation name change, mainnet upgrade, token swap. Fantom tried to complete its "second entrepreneurship" with a series of actions. However, from the TVL falling to less than $100 million, the controversy over additional issuance, to the shadow of cross-chain security that has not yet dissipated, Sonic still faces many doubts and challenges. Can the high performance of the new chain be realized? Can token swaps and airdrops save the ecosystem?

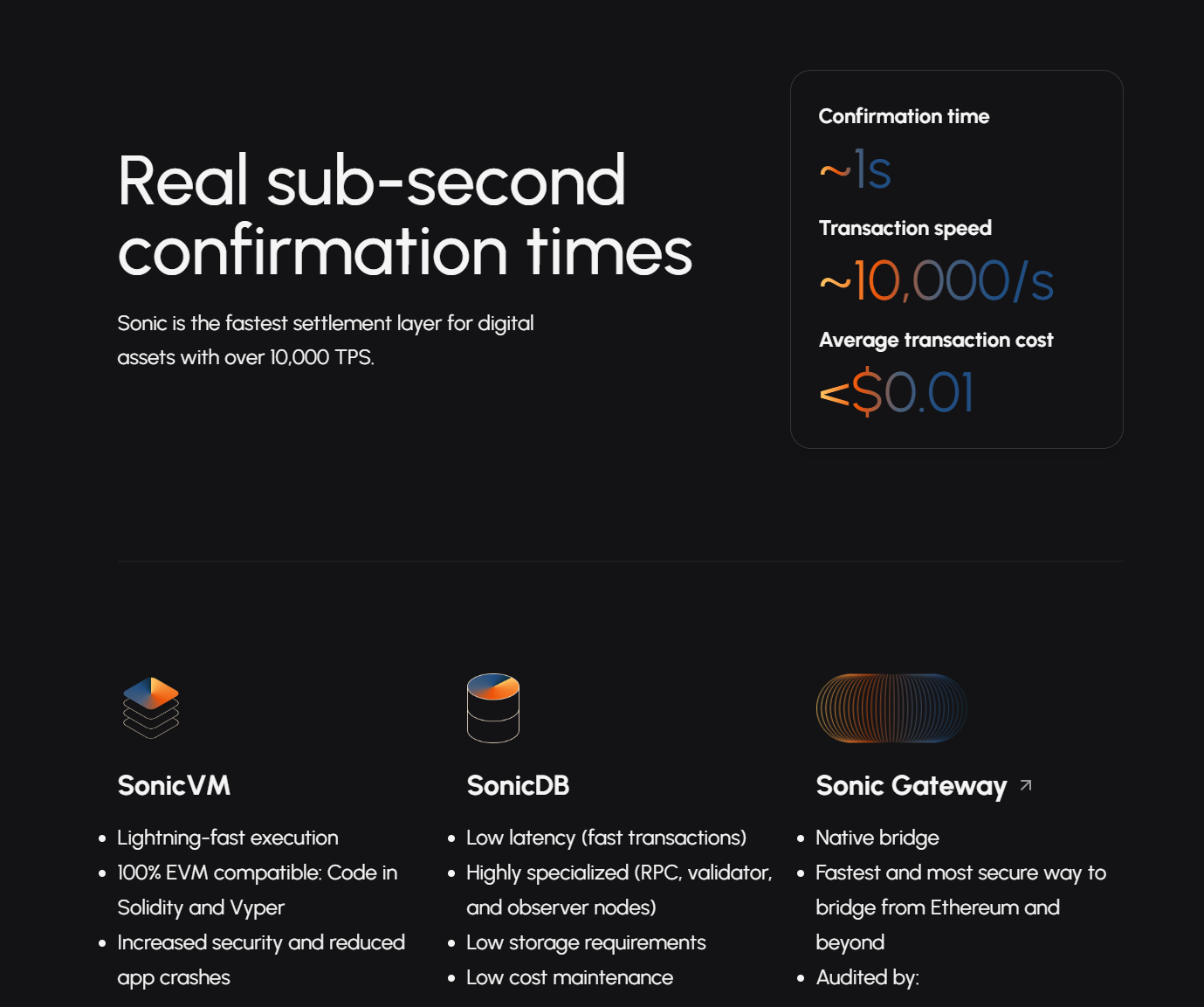

On December 18, 2024, the Fantom Foundation was officially renamed Sonic Labs and announced the launch of the Sonic mainnet. As a new public chain known for its sub-second transaction speed, performance naturally becomes the most important technical narrative of Fantom. On December 21, just three days after the launch, official data showed that 1 million blocks had been produced on the Sonic chain.

What is the secret of "speed"? According to the official introduction, Sonic has made deep optimizations to both the consensus layer and the storage layer, and introduced technical means such as live pruning, node synchronization acceleration, and database weight loss, so that nodes can confirm and record transactions with a lighter burden. The official said that compared with the old Opera chain, the node synchronization speed is increased by 10 times, and the cost of large-scale RPC nodes can be reduced by 96%, laying the foundation for a truly high-performance network.

It is worth noting that although "high TPS" is not new in the competition of public chains, it is still one of the core indicators to attract users and project parties. Fast and smooth interactive experience can usually lower the threshold of users to blockchain, and also provide possibilities for application scenarios such as complex contracts, high-frequency transactions, and metaverse games.

In addition to "high performance", Sonic said that it fully supports EVM and is compatible with mainstream smart contract languages such as Solidity and Vyper. On the surface, "self-developed virtual machine vs. compatible with EVM" was once the watershed of new public chains, but Sonic chose the latter. The advantage of this is that the migration threshold for developers is low. As long as the smart contract originally written on Ethereum or other EVM chains, it can be directly deployed to Sonic without major changes, saving a lot of adaptation costs.

In the face of the fiercely competitive public chain market, giving up EVM often means re-cultivating developers and users. Obviously, Sonic hopes to "conveniently" inherit the Ethereum ecosystem on the basis of strong performance and implement the project as quickly as possible. From the official Q&A, it can be seen that the Sonic team has also considered other routes, but based on the judgment of industry inertia, EVM is still the most "greatest common divisor" choice, which helps to quickly accumulate the number of applications and user base in the early stage.

In addition, Fantom once fell into trouble due to cross-chain in the Multichain incident. Therefore, Sonic's cross-chain strategy has also attracted much attention. The official technical documents list the cross-chain Sonic Gateway as a key technology and specifically introduce the security mechanism. Sonic Gateway uses the method of validators running clients on both Sonic and Ethereum, with decentralized and tamper-proof "Fail-Safe" protection. The design of the "Fail-Safe" mechanism is quite special: if the bridge has no "heartbeat" report for 14 days, the original assets can be automatically unlocked on the Ethereum side to protect user funds; by default, cross-chain packaging is performed every 10 minutes (ETH→Sonic) and 1 hour (Sonic→ETH), and it can also be triggered instantly for a fee; Sonic's own validator network operates the gateway by running clients on Sonic and Ethereum. This ensures that Sonic Gateway is as decentralized as the Sonic chain itself, eliminating the risk of centralized manipulation.

From a design perspective, Sonic’s main update is to attract a new round of developers and funds through “hardware configurations” such as 10,000-level TPS, sub-second settlement, and EVM compatibility, so that this old public chain can return to the market with a new image and performance.

In fact, the most discussed topic in the community is actually Sonic's new token economics. On the one hand, the 1:1 exchange FTM model seems to be equivalent to a translation. On the other hand, the airdrop plan after 6 months is equivalent to an additional 6% of tokens (about 190 million tokens), which is also considered by the community to be a practice of diluting the value of tokens.

When Sonic was first launched, it set the same initial supply (total amount) of 3.175 billion as FTM, ensuring that old coin holders could get S at a 1:1 ratio. However, a closer look reveals that the additional issuance may only be part of Sonic, and there are also many practices on total balance in token economics.

The official document shows that starting six months after the mainnet goes online, 1.5% (about 47.625 million S) will be issued every year for network operations, marketing, DeFi promotion, etc., for six years. However, if this part of the tokens is not used up in a certain year, they will be 100% destroyed to ensure that only the additional part is actually invested in construction, rather than being stored in the foundation.

In the first four years, the 3.5% annualized validator reward of the Sonic mainnet mainly comes from Opera's unused FTM "block reward share", which can avoid the minting of a large number of new S at the beginning of the launch, causing hyperinflation. After four years, the issuance of new tokens will be resumed at a pace of 1.75% to pay block rewards.

In order to hedge the inflationary pressure caused by this part of the increase, Sonic designed three destruction mechanisms:

Fee Monetization Burn: If a DApp does not participate in FeeM, users will directly destroy 50% of the gas fees in transactions generated by the application; this is equivalent to imposing a higher "deflation tax" on applications that "do not join the cooperative sharing", encouraging DApp to actively participate in FeeM.

Airdrop Burn : It takes 270 days for the vesting period to fully obtain the 75% airdrop shares; if the user chooses to unlock in advance, a portion of the airdrop shares will be lost, and these "deducted" shares will be directly destroyed, thereby reducing the circulation of S in the market.

Ongoing Funding Burn: 1.5% annual issuance for network development. If the tokens are not used up in the current year, the remaining tokens will be burned 100%. This can prevent the foundation from hoarding coins and limit the long-term crowding out of tokens by certain members.

Overall, Sonic attempts to ensure ecological development funds through "controllable issuance" on the one hand, and "destruction" at multiple points on the other hand to curb inflation. The most noteworthy is the "burning" under the FeeM mechanism, because it is directly linked to the participation level and transaction volume of DApps, which means that the more applications do not participate in FeeM, the greater the deflation on the chain; on the contrary, the more FeeM applications there are, the less "deflation tax" there is, but the developer share will increase, forming a dynamic balance between profit sharing and deflation.

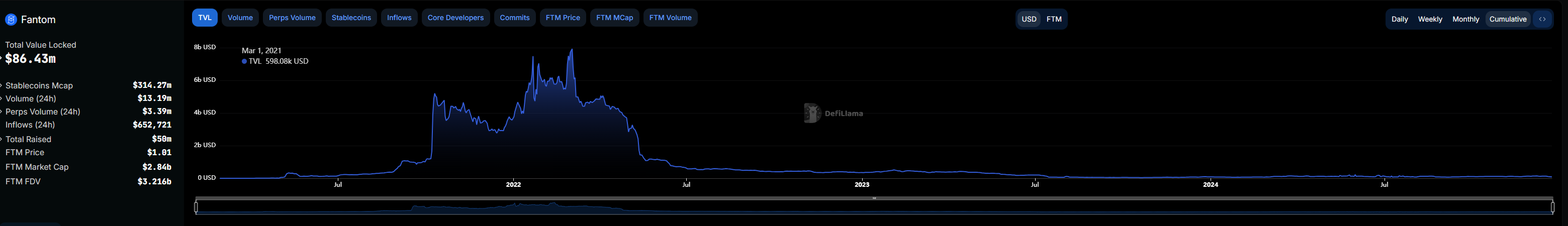

The Fantom team was once in the limelight during the bull market of 2021-2022, but Fantom's on-chain performance in the past year has not been ideal. Fantom's current TVL is only about 90 million US dollars, ranking 49th among DeFi public chains. At its peak, Fantom's TVL value was as high as about 7 billion US dollars. The current data is only about 1% of the peak period.

Perhaps in order to revive the DeFi ecosystem, Sonic has launched the Fee Monetization (FeeM) mechanism, claiming that it can return up to 90% of the network gas fee to the project party, allowing them to obtain continuous income based on the actual usage of the chain without over-reliance on external financing. This model draws on the "sharing by traffic" approach of the Web2 platform, hoping to encourage more DeFi, NFT, GameFi and other developers to come to Sonic and stay.

In addition, the official has set up an airdrop pool of 200 million S tokens and launched two ways of playing: Sonic Points, which encourages ordinary users to actively interact, hold or accumulate certain historical activities on Sonic; Sonic Gems, an incentive for developers, encourages them to launch attractive and real-use DApps on the Sonic chain. The part of S used for airdrops also incorporates mechanisms such as "linear attribution + NFT lock + early unlocking and destruction", trying to find a balance between airdrops and medium- and long-term stickiness.

The mainnet launch, the 1 million block milestone, and the cross-chain Bridge preview. These news have indeed increased Sonic's exposure in the short term. But the current reality is that the prosperity of the ecosystem is far from its peak. At present, the full competition of public chains such as Layer2, Solana, Aptos, and Sui has already brought the market into an era of multi-chain blooming. High TPS is no longer the only selling point. If Sonic cannot explode one or two "fist projects" in the ecosystem, it may be difficult to compete with other popular chains.

However, the launch of Sonic has received support from some industry star projects. In December, the AAVE community proposed to deploy Aave v3 on Sonic, and Uniswap also announced that it has completed the deployment on Sonic. In addition, Sonic can also directly inherit the 333 pledge agreements on Fantom as the ecological foundation. These are all advantages compared to a pure new public chain.

Will it rely on performance and high incentives to bring back funds and developers? The answer may depend on whether Sonic can deliver convincing answers in terms of specific application implementation, governance transparency, and cross-chain security in 2025. If everything goes well, Sonic may be able to reproduce the glory of Fantom in the past. If it only stops at concept hype, or fails to resolve internal conflicts and security concerns, this "second venture" may also return to mediocrity in the multi-chain melee.

创历届纪录!近300个项目及个人通过数据筛选、公开报名和社区推荐,进入本次评选投票阶段。谁是推动Web3和Crypto走向主流的先锋?点击图片参与投票,为你心目中的年度最佳助力!

点击下方图片立即投票!

Share to WeChat

How to earn wETH on Base through transaction gas fees?

OSL Trading Hours: Market highlights contradictory investor sentiment, Bitcoin ETF sees nearly $300 million in outflows

Meme Daily, a picture to understand the popular memes in the past 24 hours (2024.12.23)

Sonic Labs co-founder: Developers face a dilemma between decentralization and regulatory compliance

Financing Weekly Report | 18 public financing events; Stablecoin infrastructure company BVNK completes $50 million Series B financing, led by Haun Ventures

Weekly preview | MicroStrategy officially joins the Nasdaq 100 Index; Ethena (ENA) and Cardano (ADA) will unlock tokens worth tens of millions of dollars

Data analysis and visualization reporting of industry hot spots

WeChat Official Account

WeChat Official Account Contact Us

Contact Us