I’m consumed by guilt and anxiety whenever I’m not shadowing my parents’ every move. Recently, I let my guard down—and nearly watched my mum fall prey to smooth-talking con artists and their elaborate scam.

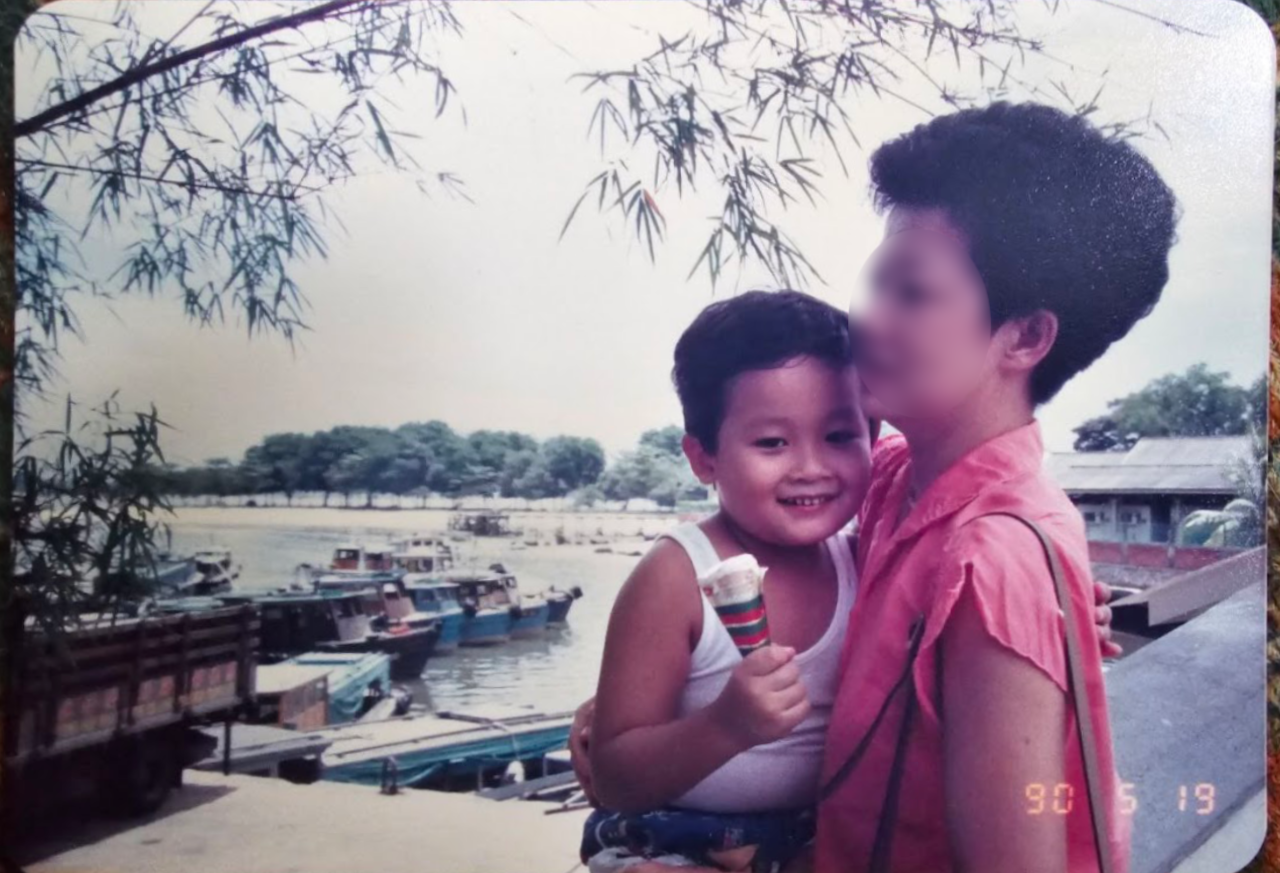

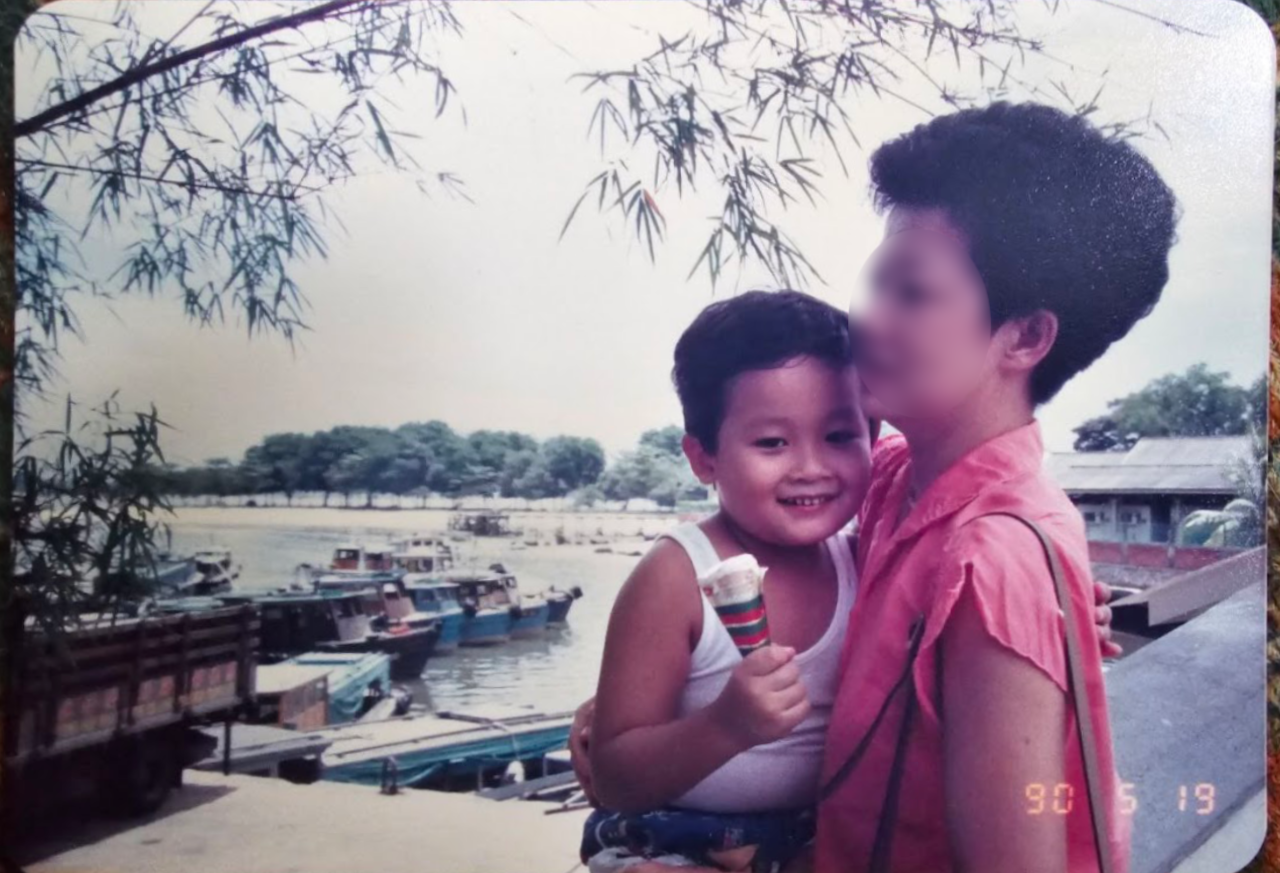

My parents devoted their lives to raising me, building a foundation of care and protection I strive to repay. But no matter how much I try, the tables can turn in an instant.

Like so many other Asians who struggle to put love into words, I channel my affection through food. Lavish meals have become my language of gratitude, a way of saying everything I can’t articulate out loud.

So, in November 2023, I decided to treat my parents to a popular hotel buffet along Orchard Road for my dad’s 74th birthday. The idea of all-you-can-eat seemed foolproof, and the restaurant buzzed with an energy that made me feel I’d chosen right.

For 35 years, my parents and I lived under the same roof, sharing everything. Even after I moved into my own place, we maintained a close bond, our regular communal meals serving as cherished check-ins, a chance to update each other on the little and big things in life.

The mood of this jovial dinner took an unexpected turn when my mum, 72, who had always taught me to be unyielding with myself, laid down a revelation that made my heart skip a beat. In a voice trembling with anger and regret, she revealed that she’d nearly lost her life savings to some mysterious strangers.

My mum’s gaze was fixed on the floor like an embarrassed child as she recounted the gaslighting she had endured, her voice trembling with anger and regret.

My fists and teeth clenched as she disclosed that she had been fooled by swindlers.

At 9 AM one morning in October 2023, my mum picked up a call from a voice that somehow knew her name.

“There has been a transaction of over S$900 on your OCBC credit card,” the caller announced, triggering a ripple of confusion within her. She owned an OCBC account, yes, but no credit card.

The supposed “bank teller” calmly asked if she wanted to cancel the transaction and file a police report. When she agreed, he “transferred” her to a police station. Thus, with the press of a button, my mother crossed a threshold, lured by skilled emotional manipulators who saw through her defences to the vulnerable heart beneath.

In reality, bank tellers will never transfer calls to the police.

“It was all so realistic,” she recalls. Her voice tightened, shame hardening into anger. She had answered his questions, divulging her bank details in full trust.

“Are you in a room alone?” the stranger on the phone asked.

“This statement must be kept secret. Not even your husband can know.” She complied, entranced by his authority.

At this point of telling her story, my mother was so angry—at the voice actors and even more so at herself—that she was swearing to herself in Teochew. She was spewing expletives from the old country that even I hadn’t heard before.

“In hindsight, all these questions were meant to gather information from me. At that time, I had to leave for work, so the fake policeman told me to call him back later.”

By the following day, the game had darkened.

“The officer was oddly… polite,” she recounted, eyebrows knitting with a mix of dread and disbelief. He asked about her day, about her meals, lulling her, it seemed, into a false sense of security.

The following day, he transferred her to his senior officer—an Inspector Yong, who surprisingly knew her personal details, including her bank account number. And with each personal detail, he baited her deeper.

Inspector Yong claimed to have uncovered her involvement in two other money laundering cases—he even described an arrest warrant in her name.

“Is there somewhere quiet where we can talk?” he gently asked.

Inspector Yong suggested they continue their confidential conversation somewhere secluded, like a nearby void deck. Again, my mum complied.

However, according to Inspector Yong, my mother could avoid arrest if she followed his instructions and logged into her online banking account.

Fortunately enough, my mum is terrible with all things involving computers, mobile apps and anything that didn’t exist in 1990.

Inspector Yong became exasperated from trying to help this senior log in. After multiple attempts, they gave up trying to access her online banking account. He said that they could try again the next day, and she went home.

Shaken but suspicious, my mother confided in my father. He quickly reached out to a friend in the force.

As soon as he mentioned the name “Inspector Yong,” the response was immediate: “You’ve been scammed.”

My mother’s cheeks flushed with shame as she realised how close she had come to losing everything. But for all her regrets, she knew she was lucky. She would have been another silent statistic if not for her blessed computer illiteracy, a shield that saved her in her moment of greatest vulnerability.

“If we had logged into my banking account and had I given him details like my OTP, he could have wiped out my life savings.”

It took a lot for my mum to recall and verbalise this brief lapse of judgment, so after she had gotten it off her chest, I changed the topic to something lighthearted. I wanted the convivial mood of the birthday dinner to continue, so I joked that her not losing her life savings made this a double celebration. My dad chimed in with amusing banter too, which earned a smile and laugh from her.

As her son, it stung. My mum has toiled for years to provide for her family and doesn’t have any indulgences because she believes that it’s more important to save for a rainy day. She was lucky that the only harm this scam caused was to her pride—she still curses ‘Inspector Yong’ and his accomplices under her breath. However, many others were not as fortunate.

We escaped financial ruin by sheer luck. When I was a child, my mother did her utmost to protect me. As an adult caring for my elderly parents, it’s frustrating that there’s little I can do to protect her besides calling her often and talking to her about new types of scams.

However, it’s heartening that she’s been reading up on scam tactics.

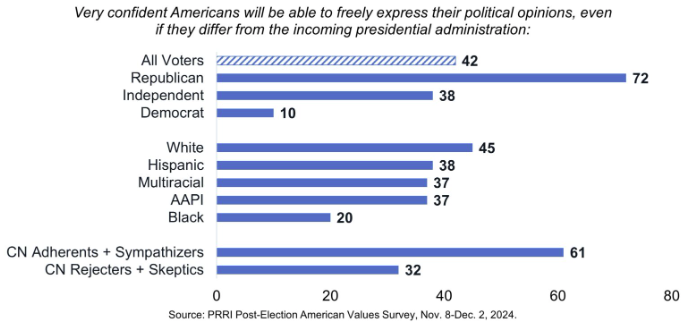

In the first half of 2024, over 26,000 victims lost S$385.6 million to scams, and it’s not just the elderly—last year, 73 percent of victims were below 50 years of age.

These days, she hopes other seniors too will take steps to protect themselves and their life savings, like downloading the ScamShield app, setting daily limits for bank transactions and activating the Money Lock feature. It’s great that ScamShield also has a 24/7 helpline (1799) that anyone can call during moments of uncertainty.

Last month, my mum received another call. This time, the caller claimed that an even larger amount had been transacted through her bank account. This time, she smirked and hung up.

“We need to inform the public what types of scams are out there and how to avoid falling for them,” she opines.

She’s wisened up to the modus operandi of scammers. Showing her how to differentiate the authentic from the suspicious hasn’t been easy, but this close call has made me more patient with teaching her.

On the unfortunate flip side, however, this attempted banking scam has made my mother even more averse to electronic services. She’ll continue to update her passbook at the bank for as long as she can walk there.

One electronic service she’s become familiar with, though, is how to lodge an online police report.

“We also need to tell Singaporeans what banking and police services can be done online and what requires our physical presence.”

In our journey towards greater personal safety, she and I have also learned that the police will never ask for information related to banking, SingPass or CPF over the phone or via text. Nor will they ever ask us to transfer money, click on links that lead to bank websites, or download apps outside of official app stores.

If required to provide any information or statements, an individual may insist on meeting ‘police officers’ like Inspector Yong at a police station in person.

“For those who aren’t aware, other people cannot apply for a credit card under your name, so if a caller makes such a claim, know that it might be a scam.”

Losing a fortune to scammers has been mentally debilitating for some victims, but for my mum, her harrowing encounter has sparked a personal mission to spread awareness to others.

She still sounds embarrassed when she shares her close shave with friends and family, but does so anyway, in the spirit of safeguarding them from scammers.

All our essential services have adopted online processes, which are hurriedly onboarding one and all, regardless of how much one knows about online security.

This urban rush, coupled with blind trust in reputable corporations and statutory boards, has led to thousands of Singaporeans being swindled every year, and these include not just the elderly but young digital natives too.

So let’s be patient with scam victims, who could do without our judgment piled atop their self-blame. While many fear reproach, reaching out quickly to avenues of support is vital to mitigating the damage.

In a high-tech world that has cut out the human touch, perhaps the best bulwark against this theatre of malicious actors can be built from human connections.

The key strategy of my mum’s scammers was to isolate her. This reaffirms the importance of checking on our loved ones frequently so none of them will ever go through such an ordeal alone.

source