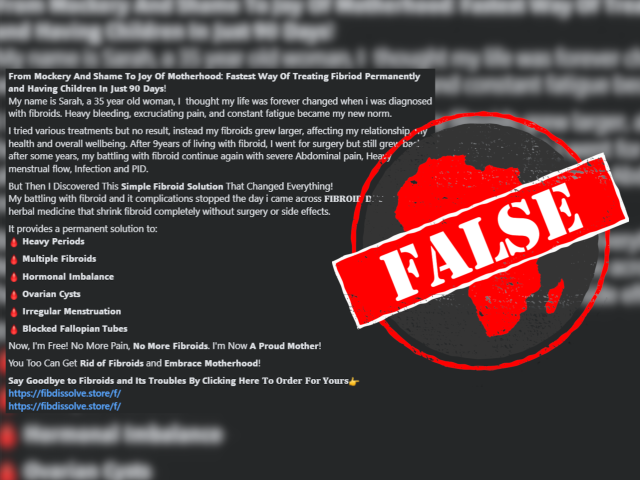

IN SHORT: Several Facebook posts are promoting what they say is a cure for fibroids. However, a gynaecologist advises patients to consult their doctor as many herbal remedies are not evidence-based.

A post on Facebook claims that herbal tablets called “Fibroid Decline” can shrink fibroids completely “without surgery or side effects”.

The 12 December 2024 post reads: “I thought my life was forever changed when I was diagnosed with fibroids. Heavy bleeding, excruciating pain, and constant fatigue became my new norm. I tried various treatments but no result … After 9years of living with fibroid, I went for surgery but still grew back after some years. But Then I Discovered This 𝗦𝗶𝗺𝗽𝗹𝗲 𝗙𝗶𝗯𝗿𝗼𝗶𝗱 𝗦𝗼𝗹𝘂𝘁𝗶𝗼𝗻 That Changed Everything!”

The post also says the pills can help women fall pregnant in just 90 days.

It encourages interested users to place their orders via the link attached.

The same claim also appears here, here, here and here.

But can these tablets really cure fibroids? We checked.

Nothing but the facts

Get a weekly dose of facts delivered straight to your inbox.

Fibroids are non-cancerous growths that form inside or on the wall of the uterus. In severe cases, they can cause infertility or miscarriage.

Some of the symptoms include heavy or painful periods, abdominal pain, lower back pain, frequent urination, constipation, and discomfort during sex.

Most fibroids do not require treatment. However, in some cases, patients may need over-the-counter pain medications, iron supplements, or gonadotropin-releasing hormone agonists, which work by shrinking fibroids.

We clicked on the link attached to the Facebook post, which took us to a website with several positive reviews, supposedly from fibroid patients who had benefited from the pills. If such reviews are not backed by scientific evidence, they should not be trusted. For your safety, it’s best not to take any medication that hasn’t been clinically tested.

The website also displayed several buttons with the messages “I WANT TO BE FREE FROM FIBROID” and “YES I WANT TO ORDER”. A clock counted down the days until the “45% off + free shipping” offer ended. This tactic was most likely used to rush users to buy the product without doing proper research.

A form at the bottom of the website requested our name, physical and email addresses, and the package we wanted to order. This is a tactic known as phishing. Scammers use it to trick people into thinking they’re placing an order (in this case), whereas they just want their personal information.

Africa Check contacted Cosmos Enyindah, a professor of obstetrics and gynaecology at the University of Port Harcourt in Nigeria.

Enyindah said, unlike orthodox medicine, many herbal mixtures were not evidence-based.

“Medicine is evidence-based, so I cannot trust any cure that is not backed by evidence. Anyone who has fibroids or any other ailment should see their doctor. In cases where there is no cure yet, we introduce clinical trials, let people do clinical trials.”

This Africa Check guide can help you evaluate health claims, quacks and cures.

We believe that everyone needs the facts.

You can republish the text of this article free of charge, both online and in print. However, we ask that you pay attention to these simple guidelines. In a nutshell:

1. Do not include images, as in most cases we do not own the copyright.

2. Please do not edit the article.

3. Make sure you credit “Africa Check” in the byline and don’t forget to mention that the article was originally published on africacheck.org.

A fact-checker has rated your Facebook or Instagram post as “false”, “altered”, “partly false” or “missing context”. This could have serious consequences. What do you do?

Click on our guide for the steps you should follow.

Africa Check is a partner in Meta’s third-party fact-checking programme to help stop the spread of false information on social media.

The content we rate as “false” will be downgraded on Facebook and Instagram. This means fewer people will see it.

You can also help identify false information on Facebook. This guide explains how.

Africa Check values your trust and is committed to the responsible management, use and protection of personal information. See our privacy policy.

For democracy to function, public figures need to be held to account for what they say. The claims they make need to be checked, openly and impartially. Africa Check is an independent, non-partisan organisation which assesses claims made in the public arena using journalistic skills and evidence drawn from the latest online tools, readers, public sources and experts, sorting fact from fiction and publishing the results.

Africa Check values your trust and is committed to the responsible management, use and protection of personal information. See our privacy policy.

We will never charge you for verified, reliable information. Help us keep it that way by supporting our work.

Africa Check values your trust and is committed to the responsible management, use and protection of personal information. See our privacy policy.

Support independent fact-checking in Africa.