Crown Coins Casino Promo: Get 2 FREE Sweeps Coins Gaming Today

source

24-hour tracking of blockchain industry news and in-depth article analysis

Author: Frank, PANews

From the once-star public chain Fantom to today's Sonic Labs, 2024 is a year of drastic changes on this Layer1 chain: foundation name change, mainnet upgrade, token swap. Fantom tried to complete its "second entrepreneurship" with a series of actions. However, from the TVL falling to less than $100 million, the controversy over additional issuance, to the shadow of cross-chain security that has not yet dissipated, Sonic still faces many doubts and challenges. Can the high performance of the new chain be realized? Can token swaps and airdrops save the ecosystem?

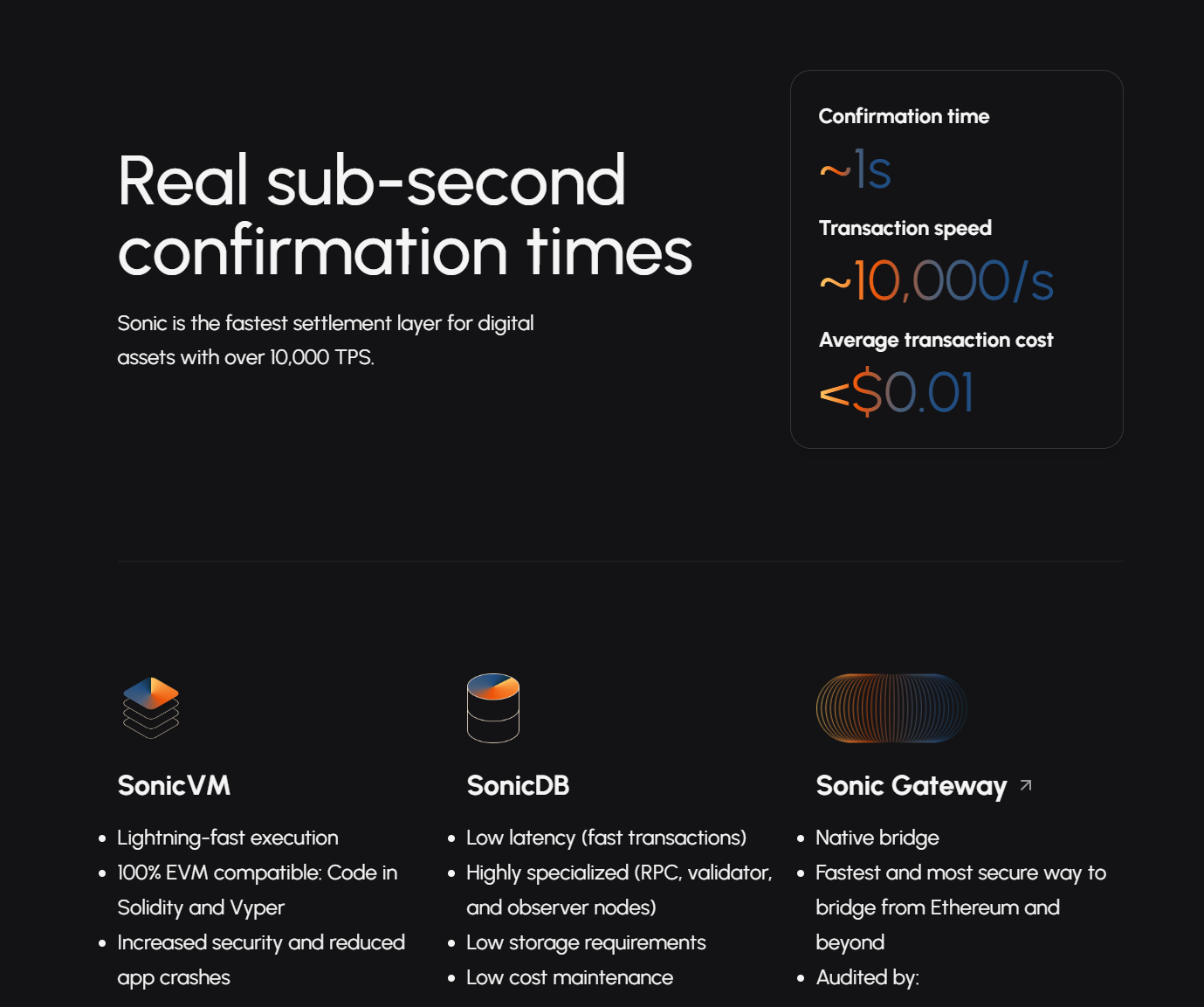

On December 18, 2024, the Fantom Foundation was officially renamed Sonic Labs and announced the launch of the Sonic mainnet. As a new public chain known for its sub-second transaction speed, performance naturally becomes the most important technical narrative of Fantom. On December 21, just three days after the launch, official data showed that 1 million blocks had been produced on the Sonic chain.

What is the secret of "speed"? According to the official introduction, Sonic has made deep optimizations to both the consensus layer and the storage layer, and introduced technical means such as live pruning, node synchronization acceleration, and database weight loss, so that nodes can confirm and record transactions with a lighter burden. The official said that compared with the old Opera chain, the node synchronization speed is increased by 10 times, and the cost of large-scale RPC nodes can be reduced by 96%, laying the foundation for a truly high-performance network.

It is worth noting that although "high TPS" is not new in the competition of public chains, it is still one of the core indicators to attract users and project parties. Fast and smooth interactive experience can usually lower the threshold of users to blockchain, and also provide possibilities for application scenarios such as complex contracts, high-frequency transactions, and metaverse games.

In addition to "high performance", Sonic said that it fully supports EVM and is compatible with mainstream smart contract languages such as Solidity and Vyper. On the surface, "self-developed virtual machine vs. compatible with EVM" was once the watershed of new public chains, but Sonic chose the latter. The advantage of this is that the migration threshold for developers is low. As long as the smart contract originally written on Ethereum or other EVM chains, it can be directly deployed to Sonic without major changes, saving a lot of adaptation costs.

In the face of the fiercely competitive public chain market, giving up EVM often means re-cultivating developers and users. Obviously, Sonic hopes to "conveniently" inherit the Ethereum ecosystem on the basis of strong performance and implement the project as quickly as possible. From the official Q&A, it can be seen that the Sonic team has also considered other routes, but based on the judgment of industry inertia, EVM is still the most "greatest common divisor" choice, which helps to quickly accumulate the number of applications and user base in the early stage.

In addition, Fantom once fell into trouble due to cross-chain in the Multichain incident. Therefore, Sonic's cross-chain strategy has also attracted much attention. The official technical documents list the cross-chain Sonic Gateway as a key technology and specifically introduce the security mechanism. Sonic Gateway uses the method of validators running clients on both Sonic and Ethereum, with decentralized and tamper-proof "Fail-Safe" protection. The design of the "Fail-Safe" mechanism is quite special: if the bridge has no "heartbeat" report for 14 days, the original assets can be automatically unlocked on the Ethereum side to protect user funds; by default, cross-chain packaging is performed every 10 minutes (ETH→Sonic) and 1 hour (Sonic→ETH), and it can also be triggered instantly for a fee; Sonic's own validator network operates the gateway by running clients on Sonic and Ethereum. This ensures that Sonic Gateway is as decentralized as the Sonic chain itself, eliminating the risk of centralized manipulation.

From a design perspective, Sonic’s main update is to attract a new round of developers and funds through “hardware configurations” such as 10,000-level TPS, sub-second settlement, and EVM compatibility, so that this old public chain can return to the market with a new image and performance.

In fact, the most discussed topic in the community is actually Sonic's new token economics. On the one hand, the 1:1 exchange FTM model seems to be equivalent to a translation. On the other hand, the airdrop plan after 6 months is equivalent to an additional 6% of tokens (about 190 million tokens), which is also considered by the community to be a practice of diluting the value of tokens.

When Sonic was first launched, it set the same initial supply (total amount) of 3.175 billion as FTM, ensuring that old coin holders could get S at a 1:1 ratio. However, a closer look reveals that the additional issuance may only be part of Sonic, and there are also many practices on total balance in token economics.

The official document shows that starting six months after the mainnet goes online, 1.5% (about 47.625 million S) will be issued every year for network operations, marketing, DeFi promotion, etc., for six years. However, if this part of the tokens is not used up in a certain year, they will be 100% destroyed to ensure that only the additional part is actually invested in construction, rather than being stored in the foundation.

In the first four years, the 3.5% annualized validator reward of the Sonic mainnet mainly comes from Opera's unused FTM "block reward share", which can avoid the minting of a large number of new S at the beginning of the launch, causing hyperinflation. After four years, the issuance of new tokens will be resumed at a pace of 1.75% to pay block rewards.

In order to hedge the inflationary pressure caused by this part of the increase, Sonic designed three destruction mechanisms:

Fee Monetization Burn: If a DApp does not participate in FeeM, users will directly destroy 50% of the gas fees in transactions generated by the application; this is equivalent to imposing a higher "deflation tax" on applications that "do not join the cooperative sharing", encouraging DApp to actively participate in FeeM.

Airdrop Burn : It takes 270 days for the vesting period to fully obtain the 75% airdrop shares; if the user chooses to unlock in advance, a portion of the airdrop shares will be lost, and these "deducted" shares will be directly destroyed, thereby reducing the circulation of S in the market.

Ongoing Funding Burn: 1.5% annual issuance for network development. If the tokens are not used up in the current year, the remaining tokens will be burned 100%. This can prevent the foundation from hoarding coins and limit the long-term crowding out of tokens by certain members.

Overall, Sonic attempts to ensure ecological development funds through "controllable issuance" on the one hand, and "destruction" at multiple points on the other hand to curb inflation. The most noteworthy is the "burning" under the FeeM mechanism, because it is directly linked to the participation level and transaction volume of DApps, which means that the more applications do not participate in FeeM, the greater the deflation on the chain; on the contrary, the more FeeM applications there are, the less "deflation tax" there is, but the developer share will increase, forming a dynamic balance between profit sharing and deflation.

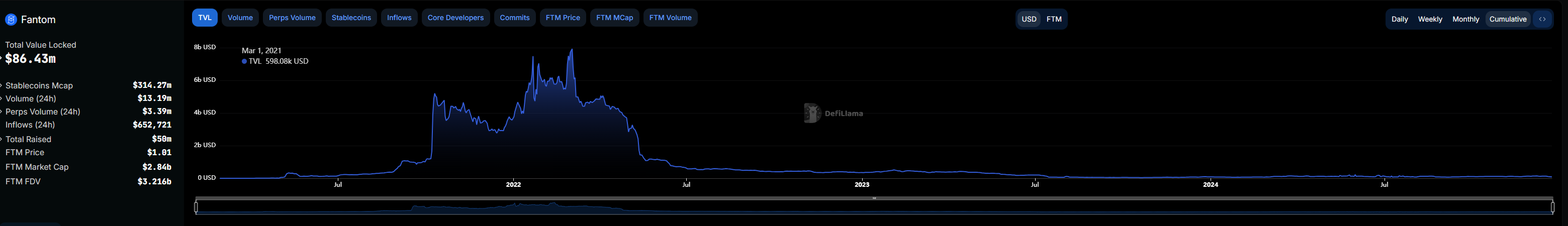

The Fantom team was once in the limelight during the bull market of 2021-2022, but Fantom's on-chain performance in the past year has not been ideal. Fantom's current TVL is only about 90 million US dollars, ranking 49th among DeFi public chains. At its peak, Fantom's TVL value was as high as about 7 billion US dollars. The current data is only about 1% of the peak period.

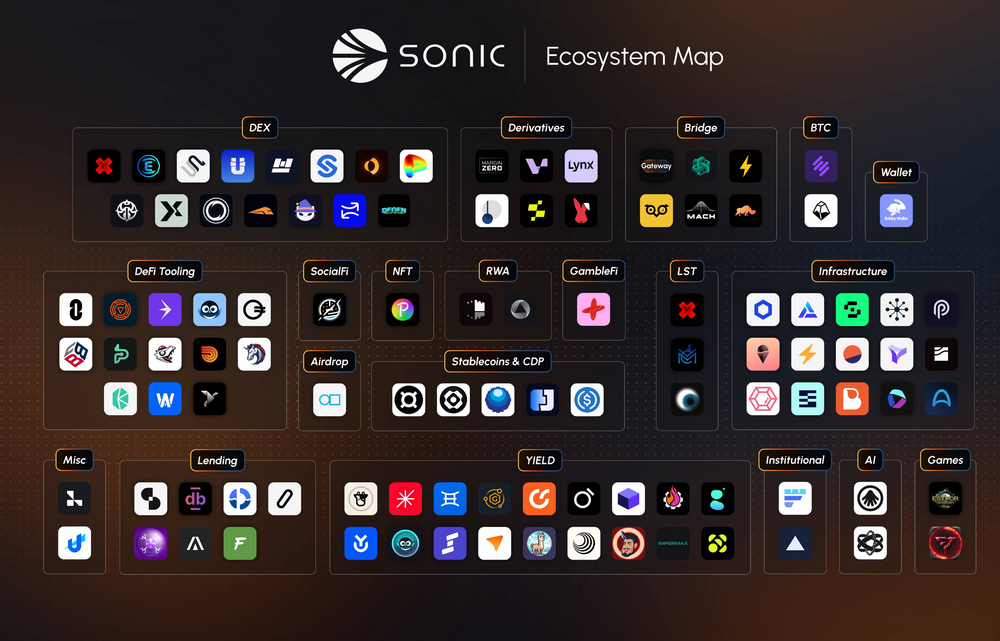

Perhaps in order to revive the DeFi ecosystem, Sonic has launched the Fee Monetization (FeeM) mechanism, claiming that it can return up to 90% of the network gas fee to the project party, allowing them to obtain continuous income based on the actual usage of the chain without over-reliance on external financing. This model draws on the "sharing by traffic" approach of the Web2 platform, hoping to encourage more DeFi, NFT, GameFi and other developers to come to Sonic and stay.

In addition, the official has set up an airdrop pool of 200 million S tokens and launched two ways of playing: Sonic Points, which encourages ordinary users to actively interact, hold or accumulate certain historical activities on Sonic; Sonic Gems, an incentive for developers, encourages them to launch attractive and real-use DApps on the Sonic chain. The part of S used for airdrops also incorporates mechanisms such as "linear attribution + NFT lock + early unlocking and destruction", trying to find a balance between airdrops and medium- and long-term stickiness.

The mainnet launch, the 1 million block milestone, and the cross-chain Bridge preview. These news have indeed increased Sonic's exposure in the short term. But the current reality is that the prosperity of the ecosystem is far from its peak. At present, the full competition of public chains such as Layer2, Solana, Aptos, and Sui has already brought the market into an era of multi-chain blooming. High TPS is no longer the only selling point. If Sonic cannot explode one or two "fist projects" in the ecosystem, it may be difficult to compete with other popular chains.

However, the launch of Sonic has received support from some industry star projects. In December, the AAVE community proposed to deploy Aave v3 on Sonic, and Uniswap also announced that it has completed the deployment on Sonic. In addition, Sonic can also directly inherit the 333 pledge agreements on Fantom as the ecological foundation. These are all advantages compared to a pure new public chain.

Will it rely on performance and high incentives to bring back funds and developers? The answer may depend on whether Sonic can deliver convincing answers in terms of specific application implementation, governance transparency, and cross-chain security in 2025. If everything goes well, Sonic may be able to reproduce the glory of Fantom in the past. If it only stops at concept hype, or fails to resolve internal conflicts and security concerns, this "second venture" may also return to mediocrity in the multi-chain melee.

创历届纪录!近300个项目及个人通过数据筛选、公开报名和社区推荐,进入本次评选投票阶段。谁是推动Web3和Crypto走向主流的先锋?点击图片参与投票,为你心目中的年度最佳助力!

点击下方图片立即投票!

Share to WeChat

How to earn wETH on Base through transaction gas fees?

OSL Trading Hours: Market highlights contradictory investor sentiment, Bitcoin ETF sees nearly $300 million in outflows

Meme Daily, a picture to understand the popular memes in the past 24 hours (2024.12.23)

Sonic Labs co-founder: Developers face a dilemma between decentralization and regulatory compliance

Financing Weekly Report | 18 public financing events; Stablecoin infrastructure company BVNK completes $50 million Series B financing, led by Haun Ventures

Weekly preview | MicroStrategy officially joins the Nasdaq 100 Index; Ethena (ENA) and Cardano (ADA) will unlock tokens worth tens of millions of dollars

Data analysis and visualization reporting of industry hot spots

WeChat Official Account

WeChat Official Account Contact Us

Contact Us

The Florida Lottery offers several draw games for those hoping to win one of the available jackpots. Here’s a look at the winning numbers for games played on Sunday, Dec. 22, 2024

10-12-30-41-49, Cash Ball: 02

Check Cash4Life payouts and previous drawings here.

Midday: 09-18-20-22-33

Evening: 01-08-10-18-23

Check Fantasy 5 payouts and previous drawings here.

Morning: 08

Matinee: 03

Afternoon: 09

Evening: 05

Late Night: 05

Check Cash Pop payouts and previous drawings here.

Midday: 0-1, FB: 5

Evening: 2-6, FB: 7

Check Pick 2 payouts and previous drawings here.

Midday: 7-7-5, FB: 5

Evening: 6-9-9, FB: 7

Check Pick 3 payouts and previous drawings here.

Midday: 1-6-9-2, FB: 5

Evening: 4-3-6-3, FB: 7

Check Pick 4 payouts and previous drawings here.

Midday: 5-0-4-6-4, FB: 5

Evening: 2-8-3-7-5, FB: 7

Check Pick 5 payouts and previous drawings here.

Tickets can be purchased in person at any authorized retailer throughout Florida, including gas stations, convenience stores and grocery stores. To find a retailer near you, go to Find Florida Lottery Retailers.

Feeling lucky? Explore the latest lottery news & results

You also can claim your winnings by mail if the prize is $250,000 or less. Mail your ticket to the Florida Lottery with the required documentation.

If you’re a winner, Florida law mandates the following information is public record:

This results page was generated automatically using information from TinBu and a template written and reviewed by a Florida digital producer. You can send feedback using this form.

A Looming Threat to Bitcoin: The Risk of a Quantum Hack The Wall Street Journal

source

Tens of thousands of people gathered in Belgrade Sunday to protest against President Aleksandar Vucic and his ruling Serbian Progressive Party (SNS). The rally, organised by students and farmer unions, was part of a wider movement demanding accountability for the collapse of a railway station roof that killed 15 people last month.

Issued on:

Tens of thousands of people streamed into a central square in Serbia‘s capital on Sunday for a rally against populist President Aleksandar Vucic and his government, whose tight grip on power has been challenged by weeks of street protests led by university students.

The rally at Belgrade’s Slavija Square, one of the largest in recent years, was called by students and farmer unions. It was part of a wider movement demanding accountability over the Nov. 1 collapse of a canopy at a railway station in the country’s north that killed 15 people.

“We are all under the canopy,” read one of the banners displayed at the main Belgrade square.

Smaller rallies were also held in the cities of Nis and Kragujevac. The protest in Belgrade started with a 15-minute silence for the victims, and later chants of “You have blood on your hands!” were heard.

Many in Serbia blame the collapse on widespread corruption and sloppy work on the railway station building in the city of Novi Sad that was twice renovated in recent years as part of questionable mega projects involving Chinese state companies. Protesters demand that Vucic and those responsible face justice.

Read moreSerbia: Anti-corruption movement gains ground after deadly train station accident

Serbia’s popular theater and movie actors joined the protest, with actor Bane Trifunovic describing Sunday’s rally as “a festival of freedom.”

In a show of confidence, the Serbian president on Sunday inaugurated a section of a newly built highway in central Serbia. Vucic said he wouldn’t budge to opposition demands for a transitional government and accused his opponents of using students to try to seize power.

“We will beat them again,” said Vucic.“They (the opposition) don’t know what to do but to use someone’s children.”

In an apparent attempt to defuse the student-led protests, Vucic has been advertising what he said are “favorable” loans for young people to purchase apartments as well as attracting tens of thousands of doctors and other skilled people who have left the Balkan country for a better life in the West in recent years.

Prosecutors have arrested 13 people over the Novi Sad tragedy, including a government minister whose release later fueled public skepticism about the honesty of the investigation.

The weekslong protests reflect wider discontent with Vucic’s rule. The populist leader formally says he wants to take Serbia into the European Union but has faced accusations of curbing democratic freedoms rather than advancing them.

Opposition parties have said a transitional government that would prepare a free and fair election could be a way out of the political tensions as ruling populists also have been accused of rigging past votes.

Serbia’s government has extended school winter holidays by starting them nearly a week earlier to grapple with widening student protests.

Classes at universities throughout the Balkan country have been suspended for weeks with students camping inside their faculty buildings. In recent days, more high school students have joined the movement. Occasional violence has erupted when pro-government thugs tried to disrupt the protests.

A group of farmers said Sunday that police took away the tractor which they drove into central Belgrade ahead of the protest. In addition to the farmers, Serbia’s students also have received nationwide support from all walks of life including their professors, media personalities, lawyers and prominent individuals.

Vucic initially accused the students of launching protests for money but later said he has fulfilled their demands, including publishing documentation relating to the renovation work at the Novi Sad station.

(AP)

© 2024 Copyright France 24 – All rights reserved. France 24 is not responsible for the content of external websites. Audience ratings certified by ACPM. ACPM

The content you requested does not exist or is not available anymore.

Imagine stepping into a digital goldmine where every coin is a stepping stone towards financial freedom. The crypto landscape is thriving, with altcoins leading the charge in reshaping the future of finance. Among this vibrant mix, a few standout names beckon investors with their innovative ecosystems and growing communities. Qubetics ($TICS), a blockchain powerhouse with its revolutionary wallet solution, is redefining accessibility for crypto users. Meanwhile, Celestia, SEI, and VeChain bring their unique offerings, from modular blockchains to seamless decentralised trading solutions.

But what sets Qubetics apart? The excitement surrounding its presale phases and game-changing features has made it a magnet for investors. Whether you’re exploring cutting-edge wallets or dreaming of portfolio growth, this article unpacks why these projects, particularly Qubetics, are the best altcoins to buy this month.

The Qubetics Wallet stands at the forefront of crypto innovation, offering a seamless bridge between users and the blockchain. This state-of-the-art wallet is the cornerstone of the Qubetics ecosystem, crafted to simplify the management of digital assets. With support for iOS, Android, and desktop platforms, the Qubetics Wallet ensures accessibility for users regardless of their preferred device.

Designed to manage $TICS tokens and a range of other digital currencies, the wallet combines security, ease of use, and flexibility. Whether you’re a seasoned investor or a newcomer, Qubetics Wallet empowers you to take charge of your financial future. This unparalleled convenience positions Qubetics as the best altcoin to buy this month, especially for those seeking a user-centric crypto management tool.

Qubetics is currently in Presale Phase 13, and the momentum is electric. Each weekly phase introduces a 10% price hike, culminating in a 20% jump in the final stage. Right now, $TICS tokens are priced at $0.034, with over $7.5M raised, 11,300+ holders, and an impressive 367M tokens sold. The post-presale target of $0.25 per token underscores the potential for high ROI, making this phase a golden opportunity for early investors.

With the next phase just around the corner, hesitation could mean missing out. Secure your spot in this presale and ride the wave of one of the best altcoins to buy this month before prices soar even higher.

Celestia is revolutionising how blockchains operate with its modular approach. Unlike traditional blockchains, Celestia separates consensus and data availability, offering developers unparalleled scalability and flexibility. This unique design fosters innovation by allowing developers to create custom chains without the bottlenecks of traditional architecture.

Its emphasis on scalability and efficiency has drawn significant attention from the crypto community, cementing its place on this list.

Celestia’s modular concept could very well be the blueprint for next-generation blockchain networks, which is why it’s made this list.

SEI is carving out its niche in the decentralised finance (DeFi) space, focusing on high-speed, low-cost transactions. Built to cater to the growing demand for decentralised trading platforms, SEI’s infrastructure is optimised for seamless performance. By addressing latency issues and offering instant finality, SEI sets a benchmark for efficiency.

Its unique proposition makes it a favourite for traders looking for reliable DeFi solutions, solidifying its spot among the top picks. SEI’s commitment to performance deserves recognition in this list of top cryptos.

VeChain is a leader in integrating blockchain technology into supply chain management. Its platform provides businesses with a transparent and secure way to track goods across the supply chain, reducing fraud and inefficiency. VeChain’s applications are vast and impactful from luxury goods to food safety.

The platform’s real-world use cases and growing enterprise adoption stand out in the crypto space. VeChain’s innovative approach to solving practical problems ensures its relevance in this list of promising altcoins.

Based on the latest research, the best altcoins to buy this month are undoubtedly Qubetics ($TICS), followed by Celestia, SEI, and VeChain. Each project brings its unique value to the table, but Qubetics stands out with its innovative wallet and explosive presale opportunities. With its ongoing presale and potential for high returns, Qubetics offers an unmissable chance to be part of a project that’s poised for exponential growth.

Don’t wait for the market to validate what investors already see. Invest in Qubetics today, where the future of blockchain innovation meets unparalleled investment potential.

Qubetics: https://qubetics.com

Telegram: https://t.me/qubetics

Twitter: https://x.com/qubetics

Meet Alex, a distinguished writer and researcher specializing in the dynamic world of cryptocurrency and blockchain technology. With a wealth of experience and an unyielding passion for staying at the forefront of this ever-evolving industry, Alex is your trusted guide in navigating the complex terrain of digital assets and blockchain innovation. Alex holds a Ph.D. in Blockchain Development, a testament to his unparalleled expertise in this field. His educational journey, combined with his multifaceted perspective, allows him to excel in dissecting the geographical and economic factors shaping the cryptocurrency market, providing insights that delve beyond the surface. What sets Alex apart is not just his professional expertise, but his personal dedication to the transformative potential of blockchain technologies. His keen research skills ensure that he remains a reliable source for industry trends and insights, helping you make informed decisions in the world of cryptocurrencies. Join Alex on this exciting journey through the crypto realm, where knowledge meets innovation, and discover the possibilities that lie within the blockchain revolution. Business Email: info@crypto-news-flash.com Phone: +49 160 92211628

About us

Contact us

Editorial Guidelines

Terms of Use

Legals

Data protection policy

Cookie Policy

*= Affiliate-Link

Type above and press Enter to search. Press Esc to cancel.

As Europe grapples with shifting geopolitical forces, Greece finds itself increasingly wary of Turkey’s rising influence in the Middle East. Discussions about the future of European security have intensified, particularly with the growing concerns about Turkish involvement in Syria and the changing US foreign policy under President Donald Trump.

Turkish operations in Syria have escalated, with Ankara playing a key role in the removal of Bashar al-Assad’s regime. This shift, coupled with Turkey’s influence over the armed factions in Syria, has caused alarm in Athens. Greek officials are uneasy about Turkey’s ability to execute complex military operations – entailing coordination between intelligence agencies, armed forces, and foreign players – signaling a major change in regional power dynamics. The concern in Athens has deepened as Turkey seeks new strategic alliances, particularly with regard to maritime zones around Cyprus.

This evolving dynamic includes the possibility of a Turkish-Syrian agreement that could directly impact Cyprus’ exclusive economic zones, further complicating Greek-Turkish relations. Analysts fear that if Turkey’s diplomatic and military influence grows unchecked, it could destabilize not only Syria but also critical parts of the Mediterranean, particularly regarding Cyprus’ energy resources.

A key element adding to this unease is Trump’s ambiguous statements regarding Turkey’s intentions in Syria. The US president-elect recently called Turkish President Recep Tayyip Erdogan “very smart,” while noting Turkey’s expansion in Syria.

Trump’s sympathy for the charismatic and authoritarian leadership figure embodied by Erdogan has been known since his first presidential term in 2016-2020. Officials in Athens are well aware of this particularity. However, at the same time, they also understand that, for Trump, the relationship with Erdogan may remain in this context of admiration on a personal level if Turkey does not play wisely the very good cards it currently holds at the Middle East table.

At the same time, Turkey’s shift away from Russia and Iran has given Israel additional leverage, further complicating the already delicate situation.

Greek officials are particularly concerned about how these developments may affect the ongoing Kurdish issue in Syria. Turkey’s stance on Kurdish autonomy in northern Syria, a point of tension with the US, remains a contentious matter. The risk of further Kurdish conflict could destabilize the region, and Greece sees this as a significant threat to its security.

Ultimately, US-Turkish priorities mean, first of all, that Greek-Turkish issues are a much lower priority for Washington.

Enter your information below to receive our weekly newsletters with the latest insights, opinion pieces and current events straight to your inbox.

PROPERTY OF: NEES KATHIMERINES EKDOSEIS SINGLE MEMBER S.A. © 2014 – 2024

Powered by ![]()